Gross Monthly Income Calculator Canada

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 10804. The 50 household income in Canada earns 44807.

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box on the left side.

Gross monthly income calculator canada. Also includes half of your monthly condominium fees. This marginal tax rate means that your immediate additional income will be taxed at this rate. Monthly Gross Income Calculator Mortgage Payoff Calculator Calculate The Monthly A Mortgage Refinance Calculator.

Net annual salary. To estimate your retirement incomes from various sources you will need to work through a series of modules. The Advanced Tax Calculator is designed for those who wish to calculate their tax commitments with more detail for example you may with you calculate your monthlyquarterlyannual tax withholdings to ensure you retain sufficient revenue to cover the cost of your annual self.

Your average tax rate is 208 and your marginal tax rate is 338. Principal Interest Taxes Heat Other Debt Obligations Gross Annual Income. Your average tax rate is 221 and your marginal tax rate is 349.

It must not exceed 42. The 5 household income in Canada earns 157486. To start complete the easy-to-follow form below.

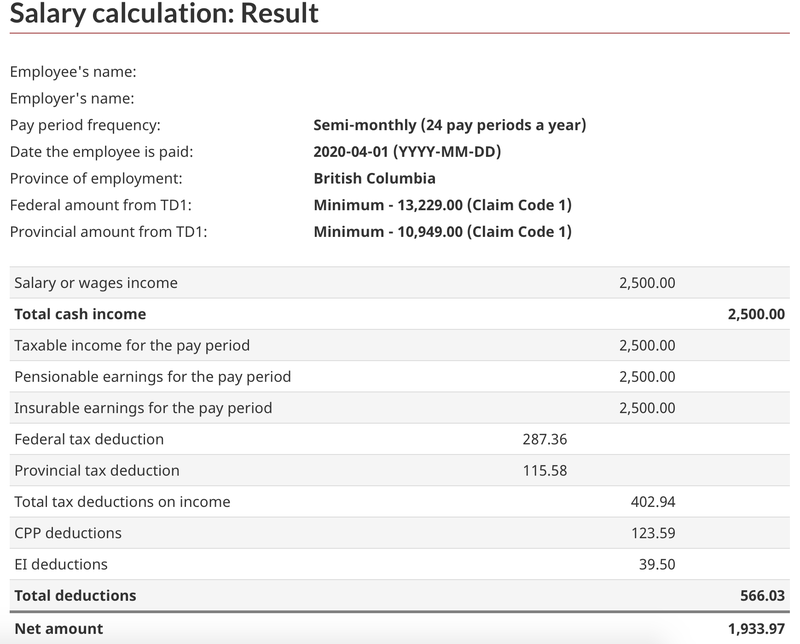

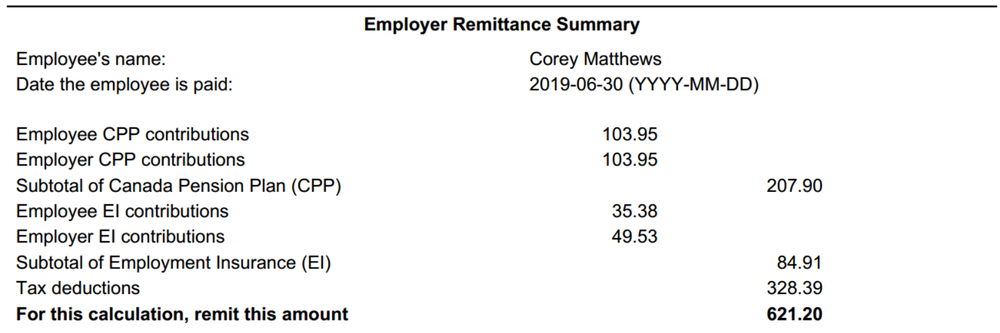

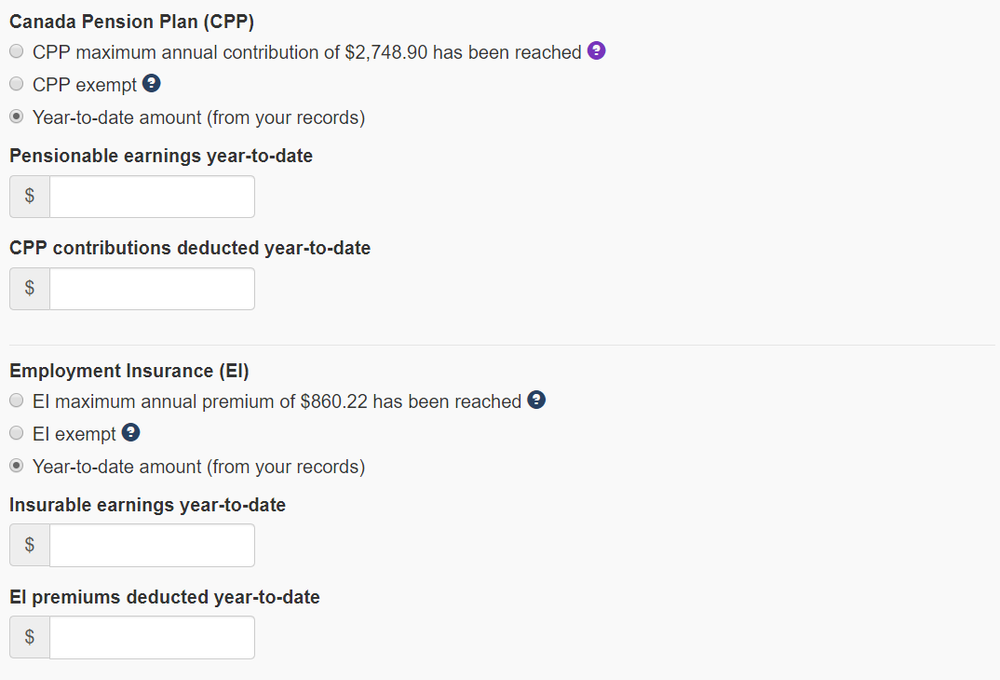

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Payments should be based on the applicable amortization period and loan amount including the CMHC premium.

CMHC restricts debt service ratios to 39 GDS and 44 TDS. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. It is perfect for small business especially those new to doing payroll.

This includes the Old Age Security OAS pension and Canada Pension Plan CPP retirement benefits. Take one of the two calculated amounts from the boxes on the right. The Canadian Retirement Income Calculator will provide you with retirement income information.

Including the net tax income after tax and the percentage of tax. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. The first affordability guideline as set out by the Canada Mortgage and Housing Corporation CMHC is that your monthly housing costs mortgage principal and interest taxes and heating expenses PITH - should not exceed 32 of your gross household monthly income.

The 10 household income in Canada earns 122274. The period reference is from january 1st 2021 to december 31 2021. The 1 household income in Canada earns 306710.

It will confirm the deductions you include on your official statement of earnings. The reliability of the calculations produced depends on the accuracy of the information you provide. Select your yearly income range.

Gross monthly income calculator canada. Its a particulalry useful tool for Expats in Canada or those looking at the expat lifestyle in Canada. The 75 household income in Canada earns 21811.

It must not exceed 35. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

TDS is the percentage of your monthly household income that covers your housing costs and any other debts. Calculate the total income taxes of the Ontario residents for 2021. Canadian Retirement Income Calculator.

Monthly gross pay without commas average weekly hours. The sum of these housing costs as a percentage of your gross monthly income. That means that your net pay will be 41196 per year or 3433 per month.

Hourly Pay Rate. The Canada Monthly Tax Calculator is updated for the 202122 tax year. Money online Tutorial March 11 2021 February 20 2021.

PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. Total Debt Service Ratio Formula. The 25 household income in Canada earns 78820.

This calculator will give you both. The payroll calculator from ADP is easy-to-use and FREE. GDS is the percentage of your monthly household income that covers your housing costs.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Gross Monthly Income Calculator. You assume the risks associated with using this calculator.

Gross monthly wage refers to your monthly paycheck before taxes and other deductions. Net salary 57 829 2 100 2 300 net salary 57 829 4 400. That means that your net pay will be 40512 per year or 3376 per month.

ADP Canada Canadian Payroll Calculator. Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review.

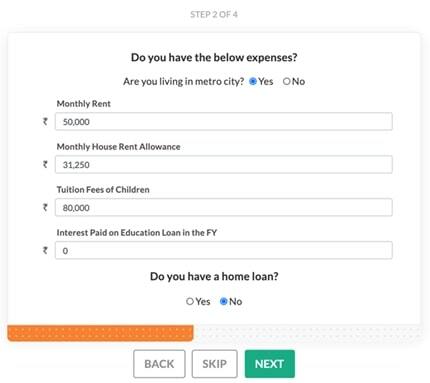

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Annual Income Learn How To Calculate Total Annual Income

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Temporary Wage Subsidy For Employers How To Calc

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Payroll Tax Deductions Monster Ca

Mathematics For Work And Everyday Life

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Gross Income Per Month The Motley Fool

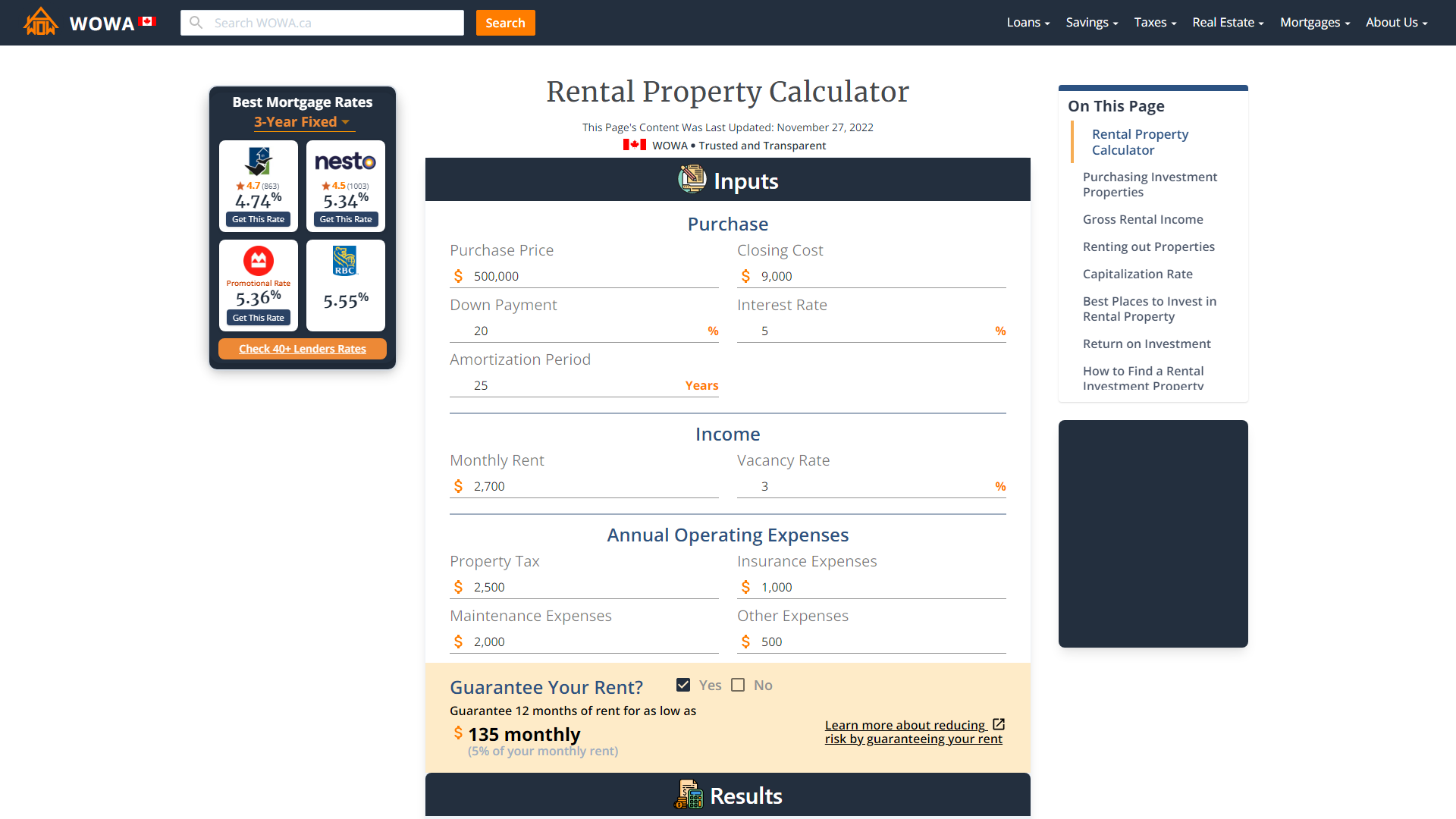

Rental Property Calculator 2021 Wowa Ca

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Net Income 12 Steps With Pictures Wikihow

Avanti Gross Salary Calculator

Post a Comment for "Gross Monthly Income Calculator Canada"