Net Salary Calculator Northern Ireland

This is the Contributions that employers are required to pay for their employees. The Latest NHS pay scales with supporting salary calculation to illustration salary deductions PAYE NICs Pension and show take home paye after tax.

Northern Ireland S Top 100 Companies 2019 By Belfast Telegraph Issuu

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Net salary calculator northern ireland. Want more stuff like this. The latest budget information from April 2021 is used to show you exactly what you need to know. This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202122.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. Call 028 9032 5822 or email infofgibsoncouk. Why not find your dream salary too.

The simple NIPAYE calculator allows you to calculate PAYENI on the salary that you pay yourself out of your limited company. Enter the number of hours and the rate at which you will get. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income.

Get the best celebrity stories straight into your inbox. Enter your Salary and click Calculate to see how much Tax youll need to Pay. Net salary calculator ireland.

Net Salary calculator for Ireland. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Income Tax NI Calculator.

Also known as Gross Income. Class 1 Contributions are paid at a weekly rate of 12 for employees who are earning between 184 and 967 and 2 for those who are earning over 967 per week. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany.

That you are an individual paying tax and PRSI under the PAYE system. Dutch Income Tax Calculator. Previous article S Pass Salary.

Hourly rates and weekly pay are also catered for. Use Deloittes Irish Tax Calculator to estimate your net income based on the provisions in the latest Budget. Why not find your dream salary too.

Final Thoughts on Calculating Your Salary. Find out the benefit of that overtime. Hourly rates weekly pay and bonuses are also catered for.

One of a suite of free online calculators provided by the team at iCalculator. The latest budget information from January 2021 is used to show you exactly what you need to know. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Youll then get a breakdown of your total tax liability and take-home pay. Salary Before Tax your total earnings before any taxes have been deducted. If you earn 72000 a year then after your taxes and national insurance you will take home 50400 a year or 4200 per month as a net salary.

Based on a 40 hours work-week your hourly rate will be 3463 with your 72000 salary. Next article Sid Seixeiro Salary. The Salary Calculator tells you monthly take-home or annual earnings considering Irish Income Tax USC and PRSI.

The calculator covers the new tax rates 2021. Hopefully this article has helped you understand a little more about calculating your monthly and annual salary. Sarahs annual earnings are 5736012 after tax.

What do you think. Leave this field empty if youre human. A minimum base salary for Software Developers DevOps QA and other tech professionals in Ireland starts at 35000 per year.

This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. Our tax calculator uses tax information from the tax year 2014 2015 to show you take-home pay if you need to see details of PAYE and NI for a different year please use our advanced options. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany.

For other sources of income and benefits in kind the calculator assumes that these. Want to check your net pay. Tax and NI Calculator for 202122 Tax Year.

Written by Net Worth. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. The next time you read your monthly payslip you will know whether the deductions are accurate.

How to use the Take-Home Calculator. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month. For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately.

Https Www Nweurope Eu Media 13425 Hydrogen Exploring Opportunities In The Northern Ireland Energy Transition March 2021 Pdf

Pdf Countering Terrorism In Northern Ireland The Role Of Intelligence

Unemployment Benefits In Northern Ireland

Average Salary In Northern Ireland 2021 The Complete Guide

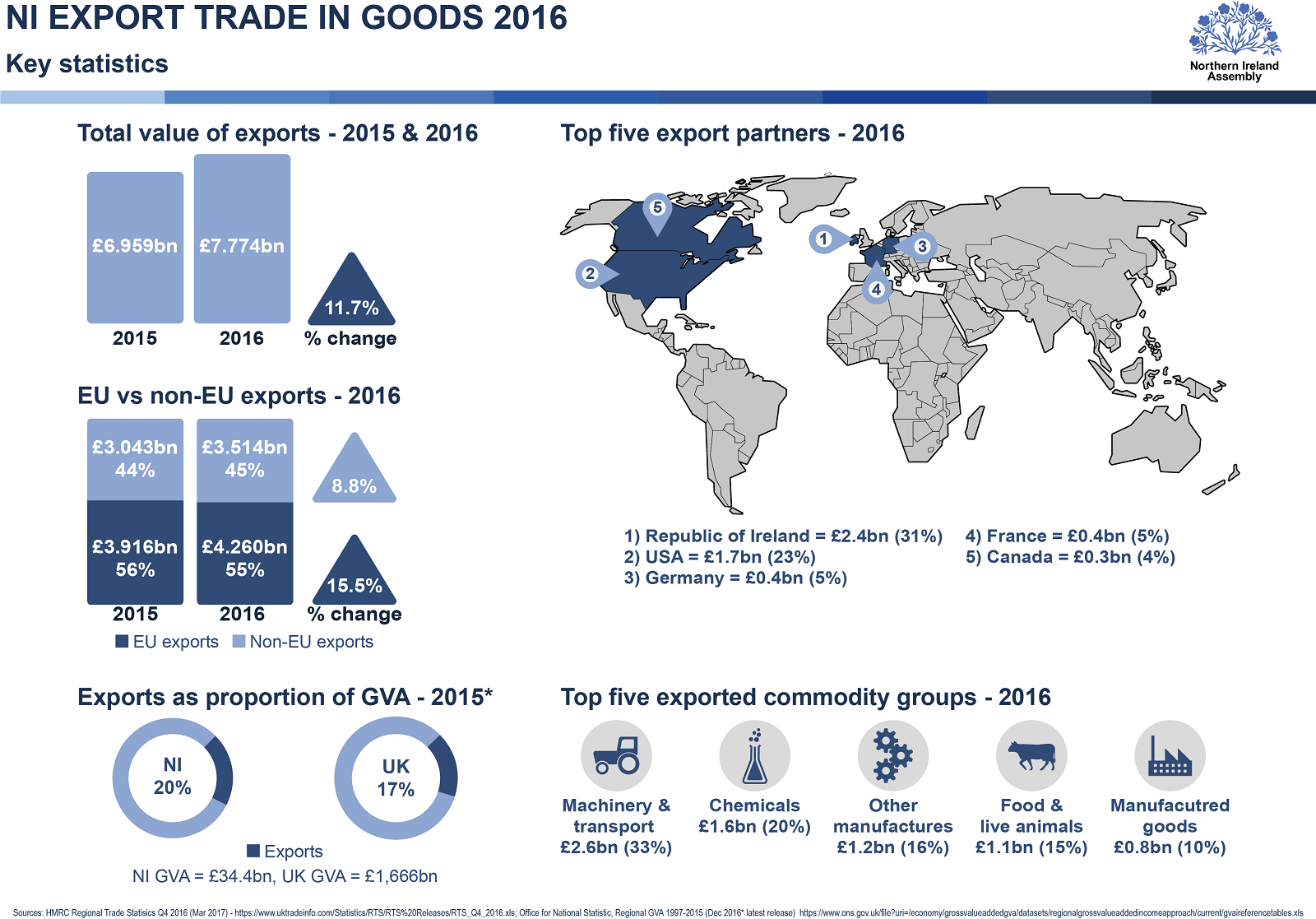

What Goods Does Northern Ireland Export How Much Are They Worth And Where Do They Go Research Matters

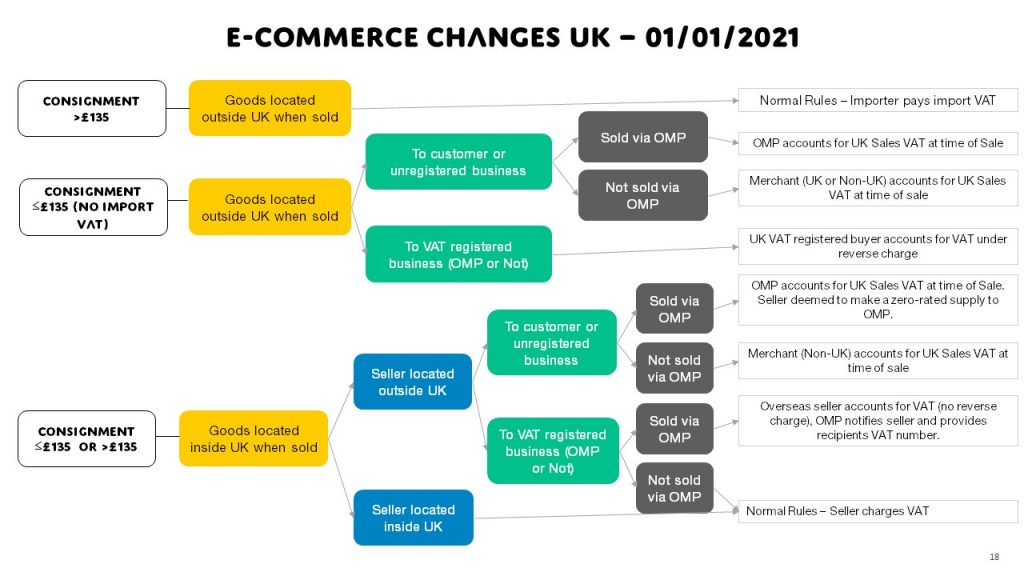

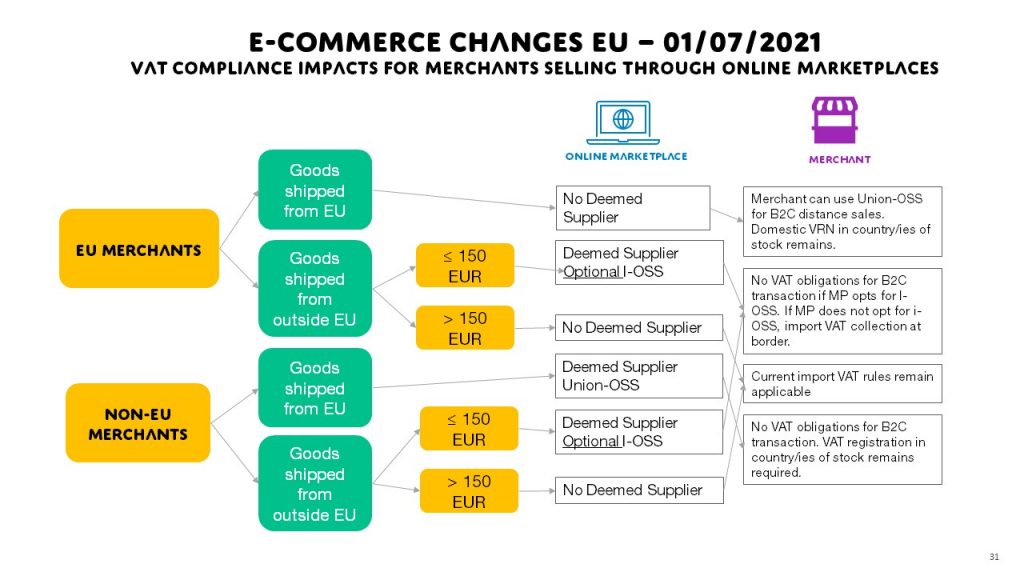

Brexit Vat And Customs Duty Prepare Now Accountancy Europe

Public Spending And Taxation The Institute For Government

Used Cars For Sale In Northern Ireland Autotrader Uk

Arrangements For Booking The Covid 19 Vaccine

Https Www Nasuwt Org Uk Uploads Assets Uploaded 8cd02a0e 5bbd 4ceb A160ee97ccc2f971 Pdf

Student Finance England On Youtube Student Finance Student Loan Companies Finance

The Financial Benefits Of The Supporting People Programme In Northern Ireland Nicva

Estate Agents Northern Ireland Reeds Rains Estate Agents

Sport Northern Ireland Facebook

Brexit Vat And Customs Duty Prepare Now Accountancy Europe

Nasuwt Northern Ireland Posts Facebook

29 500 After Tax 2021 Income Tax Uk

Post a Comment for "Net Salary Calculator Northern Ireland"