Net Salary Usa California

Lower limit of top 5. If you earn 12000000 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis.

Pin On The Adventurous Nurse Blog

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Net salary usa california. California 80k Salary Example. The amount you withhold depends on information on each team members Form W-4 or DE 4. Census Bureau Number of cities that have local income taxes.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Your employees may be subject to two state payroll taxes. The tables below show employment figures average salary information by hour week month and annual salaries in Metropolitan and Non Metropolitan areas of California.

The average Registered Nurse Salary in California CA is 102700 which is well above the national average for RNs. Men receive an average salary of 94211 USD. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

For the calculation we will be basing all of our steps on the idea that the individual filing their taxes has a salary of 12000000. California 60k Salary Example. California is one of the seven.

The latest tax information from 2021 is used to show you exactly what you need to know. Women receive a salary of 69940 USD. California 45k Salary Example.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. California 50k Salary Example. The most paid careers are Engineers Technicians V with average income 124524 USD and Management Business with income 109924 USD.

180 USA Salaries in California US provided anonymously by employees. California 85k Salary Example. California 70k Salary Example.

What salary does a NET earn in California. Why not find your dream salary too. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Here the tax rate is 01 for all employers. California 90k Salary Example. Registered Nurse Salary in California.

Hourly rates and weekly pay are also catered for. There are approximately 282290 Registered Nurses employed in the state of California across a range of industries. That means the 2019 maximum youll pay per employee is 7.

Based on education the highest salaries receive people with Doctorate Degree with salary of 125757 USD. California 65k Salary Example. What salary does a California earn in California.

Average top 5 income. Use this California gross pay calculator to gross up wages based on net pay. California 55k Salary Example.

California 75k Salary Example. That means that your net pay will be 42930 per year or 3577 per month. Median household income in California.

5726 California Salaries in California US provided anonymously by employees. Federal Salary Paycheck Calculator. Select a state to add state and local taxes.

California 95k Salary Example. California income tax rate. Your average tax rate is 220 and your marginal tax rate is 397.

If you make 55000 a year living in the region of California USA you will be taxed 12070. RNs in California earn an average of 102700 each year or 8560 monthly or 4937 hourly. 41 lignes Average salary in California is 93381 USD per year.

This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012. Bureau of Labor Statistics How Much Will I Earn as an RN in California. To be rich in California means youve really hit the big time says GOBankingRates.

California personal income tax. California Paycheck Quick Facts. It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount.

However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown. What salary does a USA earn in California. This figure can fluctuate based on your city of residence your employer and your overall nursing experience.

The Salary Calculator tells you monthly take-home or annual earnings considering Federal Income Tax Social Security and State Tax. 827 NET Salaries in California US provided anonymously by employees.

20 U S Companies That Paid 0 In Taxes Company Tax Us Companies

80 000 After Tax Us Breakdown July 2021 Incomeaftertax Com

19 Salary Certificate Formats Word Excel Pdf Templates Certificate Templates Certificate Format Certificate Of Participation Template

Comparison Of Uk And Usa Take Home The Salary Calculator

Understanding The Income Statement Income Statement Profit And Loss Statement Income

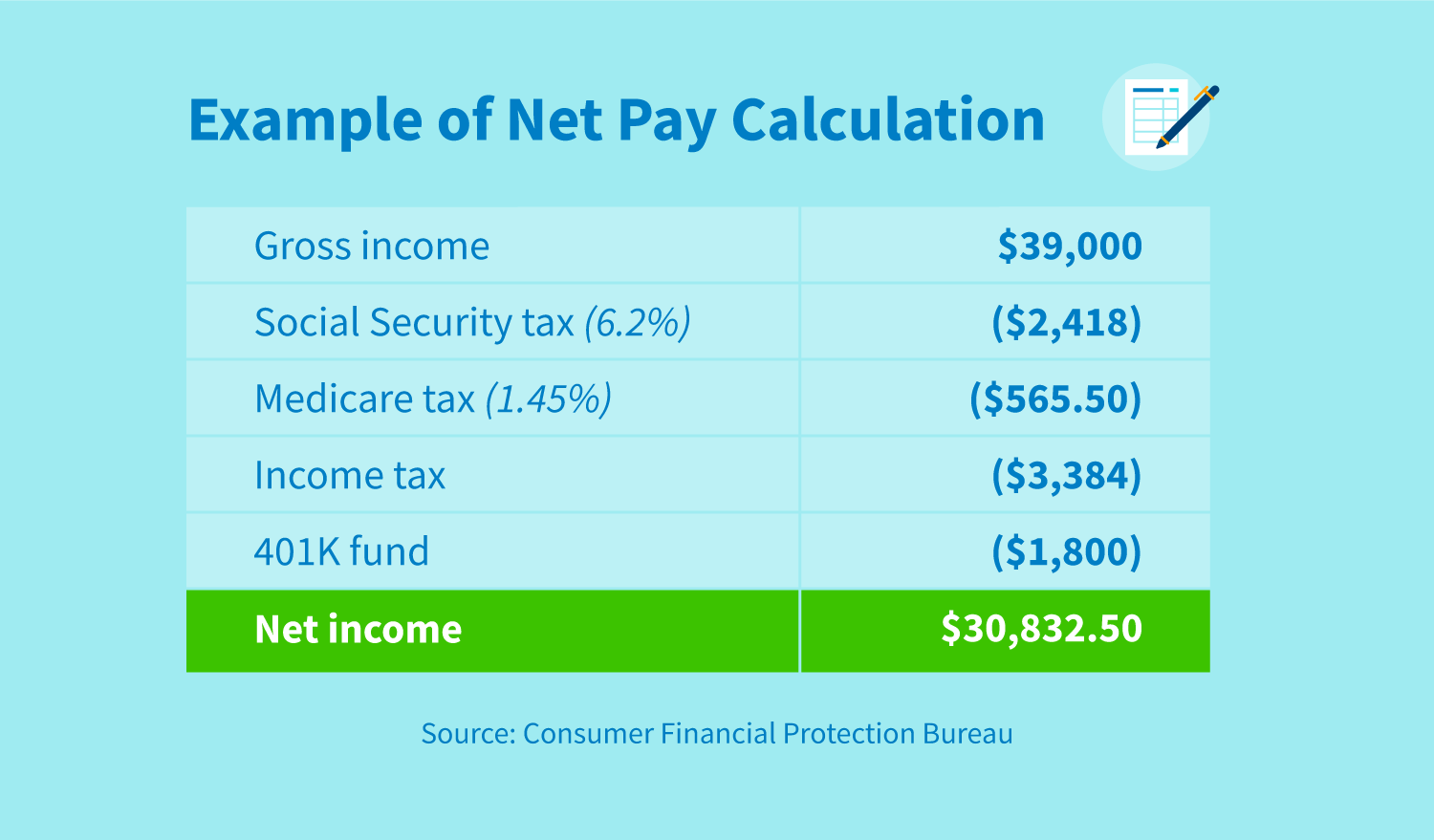

Gross Income Vs Net Income Creditrepair Com

How Do Earnings And Revenue Differ

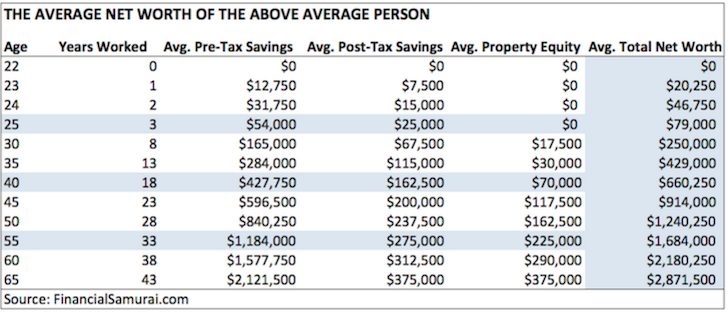

The Average Household Income In America Financial Samurai

Gross Income Vs Net Income Creditrepair Com

What Is Income Before Taxes Income Economic Analysis Federal Income Tax

Average Salary In Italy By Region Statista

Younger Startup Founders Pay Themselves Lower Salaries

Hmrc Tax Refund Revenue Online Services

Apple Net Income By Year 2005 2018 Statista

Average Software Developer Salaries Sweden Vs Ukraine Tech Outsource Engineering Software Engineer Software Development Software

Distributable Net Income Tax Rules For Bypass Trusts Tax Rules Net Income Income Tax

A Complete Manual For Recording Independent Work Charges David Gene Neugart In 2021 Woocommerce Enrolled Agent Irs Forms

Pin On Black Tie Vip Event Rentals

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

Post a Comment for "Net Salary Usa California"