Gross Annual Income Prior To Disability

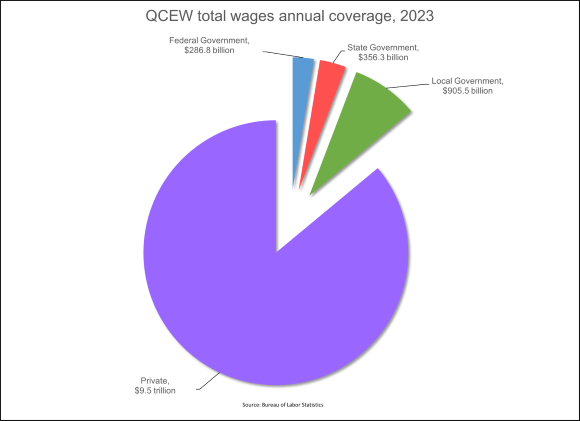

Comparing the households gross annual anticipated income per HUD guidelines to the LIHTC 50 or 60 area gross median income limits that apply to the project. Wages salaries tips etc.

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

A family unit with two adult recipients where only one recipient has the Persons with Disabilities designation.

Gross annual income prior to disability. You can earn up to an extra 2460 per fortnight for each dependent child without reducing your pension. Prior to any termination of benefits a disability retiree must be given notice and an opportunity to be heard by the retirement board. The prior years state federal or Tribal tax return.

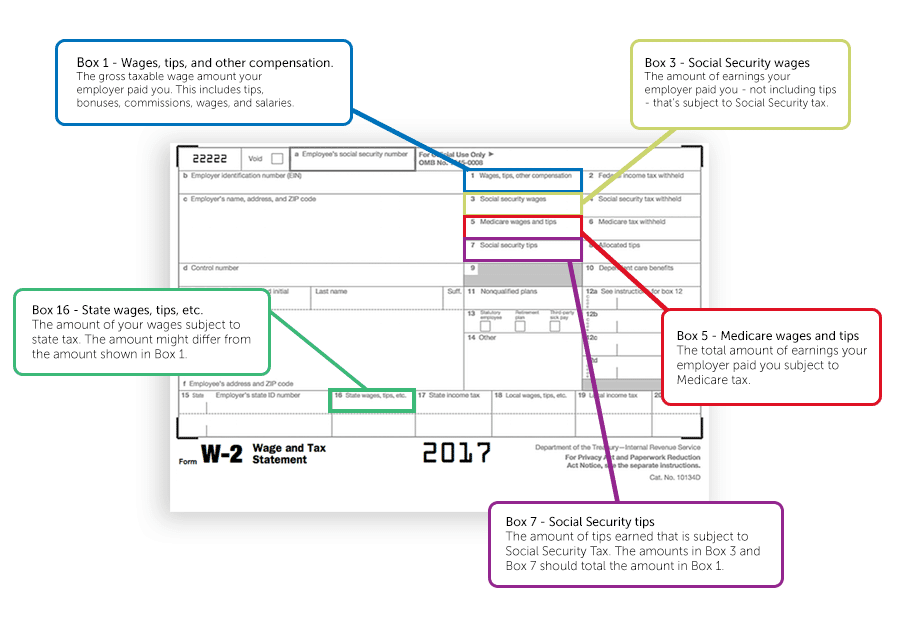

Taxable amount of pension annuity or IRA distributions. Based on such factors as years of service and prior com-Internal Revenue Service pensation. Internal Revenue Code IRC Section 105 indicates that LTD STD and SDI benefits as sick pay are to be included in the gross income of employees if the employer pays part or all of the premium for the coverage.

Policy premiums generally range from 1 to 3 of gross income. Current income statement from an employer or paycheck stub. The amount of daily benefits and the disability pension cannot exceed 70 of gross annual income.

1500 x of qualifying months in calendar year. If a disability retiree fails to submit an Annual Statement of Earned Income and the tax forms required by PERAC and does not show good cause for this failure the retirees rights to a disability retirement allowance will be terminated for the period of non-compliance. 480 For household members that are 18 and older but are full time students you only need to count the first 480 of their income.

Where employees and the employer both contribute to the cost of the disability policy the three-year look back rule generally determines what portion of the benefits paid to the employee are included within gross income. A response within 10 days after your request is received. Taxable and non-taxable Social Security and Social Security Disability Income SSDI Business income farm income capital gain other gains or loss Unemployment compensation.

The upper income limit for SSI applicantsabout 1650 per monthdoes apply to blind SSI applicants and recipients. 93 ANNUAL INCOME 7 CFR 3555152B Annual income will include all eligible income sources from all adult household members not just parties to the loan note. In 1928 Greyhound had a gross.

The adjusted annual income determines if the household is eligible for a guaranteed loan. But many blind applicants and recipients have significant impairment-related blind work expenses BWE which can be deducted from their countable income to lower their income so that it doest lower their SSI payment as much. De très nombreux exemples de phrases traduites contenant annual gross family income Dictionnaire français-anglais et moteur de recherche de traductions françaises.

In terms of gross annual income women earned nearly 40 per cent less than men in 2010. Enter annual gross income from line 9. 18000 maximum annual exemption for qualifying income.

Deduct the amount of spousal support paid from the spouses gross income to establish the spouses gross income. 48000 FOR EACH DEPENDENT Dependents including household members under the age of 18 elderly dependents handicapped disabled or full-time students but not the. They can be either fixed under which.

The cost of benefits for the disability programs as a portion of gross domestic product GDP rose dramatically during the 1990s increasing from 126 percent of GDP in 1990 to nearly 2 percent in 2001. Primary borrower underwritten gross annual income not rent. For a prior child support obligation as child support is paid on a net or after-tax basis the calculation is slightly more complicated.

If your gross annual income is 135 or less than the federal poverty guidelines you qualify for Lifeline. As previously mentioned in Section 27H of this manual student status may also affect the eligibility of a household. Mitsubishi Motorway AnnuityAn annuity is a series of payments under a Bloomington IL 61705-6613 contract made at regular intervals over a period of more than one full year.

Disability benefits paid to an individual attributable to the contributions of the employer are included in gross income. What to include in your income. Several factors influence the final premium for disability income insurance.

Adjusting for a prior spousal support obligation is simple as spousal support is paid on a gross or before-tax basis. To prove your gross annual income show one of these items. The student is also an eligible dependent which means the applicant will also receive a 480 deduction to their annual income calculation.

Also see Policy Employment Income Disability Assistance Use 02 One Time Net Earnings. First gross up the child support. The annual income for the household will be used to calculate the adjusted annual household income.

Transitional rate with dependent children. Gross annual income levels from 2001 to 2003 were reflective of employment levels. In these situations the disability benefits received by.

Couples living together and both getting a pension can each earn an extra 1230 per fortnight for each dependent child. De très nombreux exemples de phrases traduites contenant a gross income Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Understanding Your Pay Statement Office Of Human Resources

A Closer Look At Oregon S Median Household Income Article Display Content Qualityinfo

Definitions Of A Middle Class Income Consider Yourself Middle Class

Employment And Wages Annual Averages 2019 U S Bureau Of Labor Statistics

Https Www Unece Org Fileadmin Dam Stats Publications Canberra Group Handbook 2nd Edition Pdf

Mean Percentage Of Monthly Household Income Spent On Food By Gross Download Scientific Diagram

Gross And Net Income What S The Difference Ticket To Work Social Security

How Much Would You Receive From Disability Benefits Washington Post

French Social Security And How To Claim Benefits Expatica

Mean Percentage Of Monthly Household Income Spent On Food By Gross Download Scientific Diagram

7 2 Gift Taxation Cpa Exam Cpa Exam Reg Cpa

Fillable Form 1003 2009 2016 In 2021 The Borrowers Fillable Forms Mortgage Loans

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Salary Vs Net Salary Top 6 Differences With Infographics

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Fillable Form 1040 Individual Income Tax Return In 2021 Income Tax Return Income Tax Tax Return

What Is Considered Mass Affluent Based Off Income And Net Worth

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Post a Comment for "Gross Annual Income Prior To Disability"