Net Salary Calculator Russia

If you make 0 a year living in Russia we estimate that youll be taxed 0. We bring you the salary calculator for selected countries.

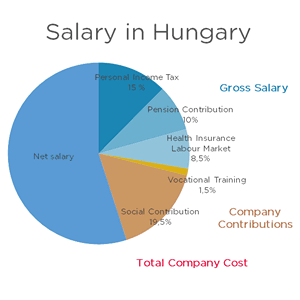

How Do You Calculate Salary And Contributions In Hungary Employment In Hungary Helpers

The latest budget information from April 2021 is used to show you exactly what you need to know.

Net salary calculator russia. The calculator is for reference only. Why not find your dream salary too. Get access to our salary comparison calculator by signing up.

The assumption is that the employee is employed full-time and there are no additional charges. Compare salaries city by city with our free salary wizard and convert your own salary to a local salary. This is the average monthly salary including housing transport and other benefits.

What salary does a Russian Analyst earn in your area. Average Salary Russia. The UKs income tax and National Insurance rates for the current year are set out in the tables below.

Average salary in Russia is 3044391 RUB per year. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here. The standard rate for the employee is 635 and the employer pays 2990 of an employees salary.

Russie - Salaire Comment trouver un travail Les meilleures villes pour trouver un emploi sont Quel salaire et combien gagne un. Enter your salary into the calculator above to find out how taxes in Russia affect your income. 107 Russian Analyst Salaries provided anonymously by employees.

The minimum social security tax payed by an employee is 802 EUR and the maximum is 2858 EUR. If the calculator for your country is missing let us to know and we will add the country there. A person working in Russia typically earns around 104000 RUB per month.

There is no separate capital gains tax in Russia therefore gains from. These include income tax as well as National Insurance payments. Earnings subject to income tax in Russia Taxes on income and salary in Russia.

The personal income tax for Russian residents citizens and foreigners is a flat 13 for all levels of income. Salaries are different between men and women. Conversion of monthly gross income to net wage.

This calculator takes major factors for consideration but it ignores a lot of minor things specified by employment and taxes law. To calculate net earnings take-home earnings taxes and other salary components you have to include huge number of factors type of work agreement costs of generating income the insurance participation and a lot more. You are paid in gross salary but you need to know what your budget is for paying for all costs of living.

Please fill in all fields in the form. The system is based on marginal tax. Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. All data are based on 1070 salary surveys. A resident of Russia living in the country for more than 183 days per calendar year must pay tax on income arising from a number of sources including wages self-employment dividends interest from investments and savings rents and royalties.

The most typical earning is 880263 RUB. Salaries vary drastically between different careers. Our 2021 payroll calculator allows companies and employees to estimate a net salary and total cost of labor including personal income tax owed PIT social security contributions and other taxes.

The calculator is designed to be used online with mobile desktop and tablet devices. Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. Use the salary calculator above to quickly find out how much tax you will need to pay on your income.

Income tax is paid on your personal earnings. Salaries range from 26200 RUB lowest average to 463000 RUB highest average actual maximum salary is higher. The Annual Wage Calculator is updated with the latest income tax rates in Russia for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income.

For this job type Moscow ranks 216th for salaries among 265 cities. Software Engineer salaries in Moscow are low. Men receive an average salary of 3284630 RUB.

Is a tax payed by both the employee and the employer. For non-residents those who spend less than half the year in Russia the rate is 30 but a relevant double taxation treaty between Russia and a foreign state can entail a different rate. Hourly rates weekly pay and bonuses are also catered for.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

Police Officer Average Salary In Russia 2021 The Complete Guide

How To Calculate Foreigner S Income Tax In China China Admissions

Factory And Manufacturing Average Salaries In Russia 2021 The Complete Guide

Police Officer Average Salary In Russia 2021 The Complete Guide

Why Are Salaries So Low In France And In The Uk Quora

Average Wage In Europe And Russia By Ppp In 2020 Jobzey

Uk Salary Calculator Template Spreadsheet Eexcel Ltd

Czech Gross Net Salary Calculator 2021 22 Pragueexpats

Elementary School Teacher Average Salary In Russia 2021 The Complete Guide

2020 Payroll Calculator For Russia Accace Outsourcing And Advisory Services

Developer Programmer Average Salary In Russia 2021 The Complete Guide

Coding Salaries In 2019 Updating The Stack Overflow Salary Calculator Stack Overflow Blog

Russia Salary Calculator 2021 22

Elementary School Teacher Average Salary In Russia 2021 The Complete Guide

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Why Are Salaries So Low In France And In The Uk Quora

Post a Comment for "Net Salary Calculator Russia"