Salary Sacrifice Used Car

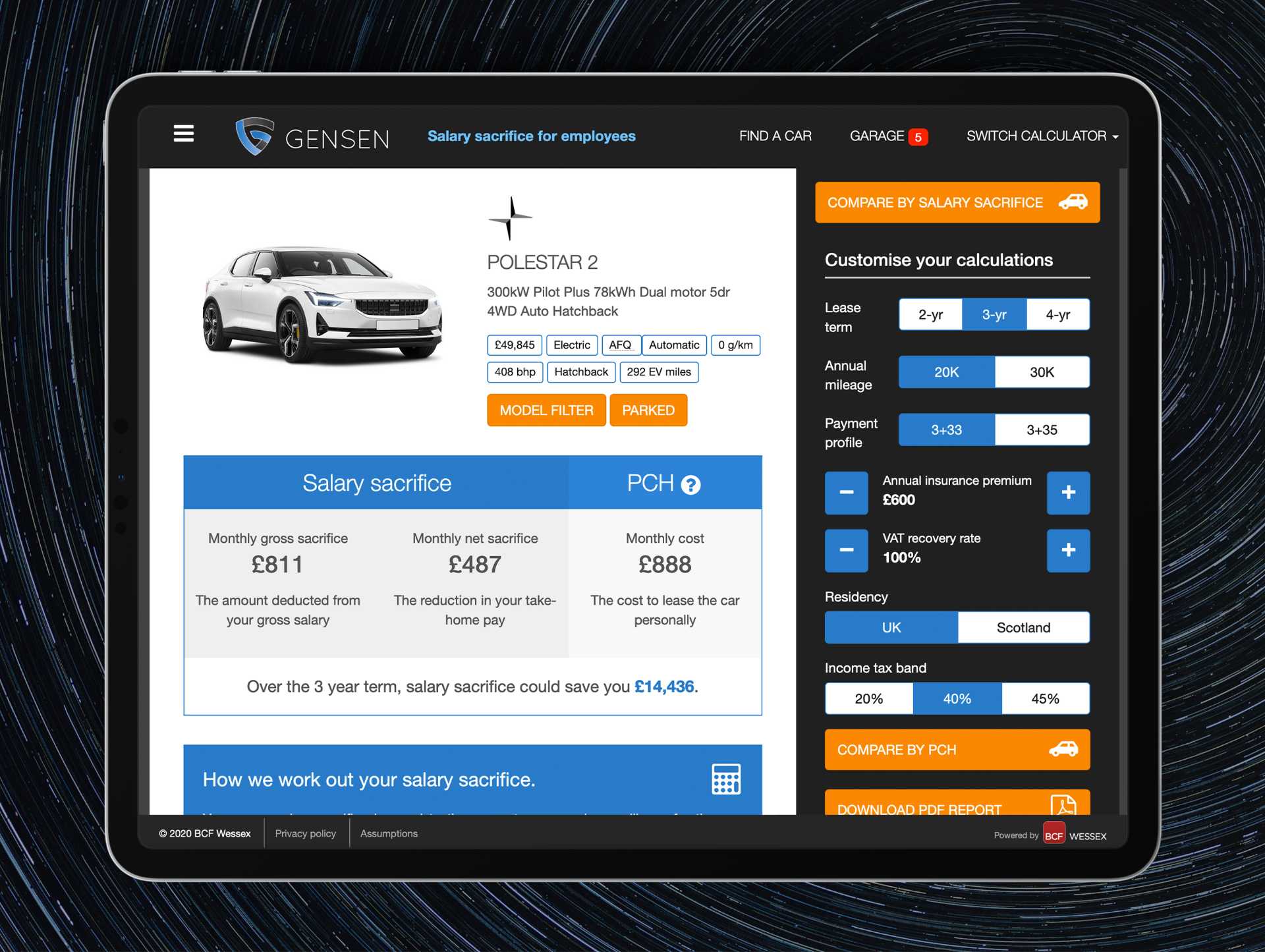

If this is the path you choose you will not have to pay a deposit and all of the main running costs will be included in the price. The employer makes repayments to the leasing company out of the employees pre-tax salary.

Salary Sacrifice Your Questions Answered For Electric Cars Electrifying

What rules affect salary sacrifice.

Salary sacrifice used car. A salary sacrifice car is a company car. Benefits of salary sacrifice car. Your company rents the car from a supplier such as LeasePlan and you rent it from your employer.

Car salary sacrifice schemes mean you can exchange some of your pre-tax salary for the benefit of a car instead. You should also enquire as to your employers. Salary sacrificing or novated leasing is a cost-effective way to buy a new or late model second-hand car.

Were going over the myths around salary sacrifice in 2021. HMRC clarifies Salary Sacrifice Car Scheme Tax. You pay for the car using your gross pay and your income tax is based on your remaining salary and the BIK value.

Salary sacrificing is a financing option that lets you make car repayments out of your pre-tax salary reducing what you pay in. What is a salary sacrifice car. For electric cars the BiK rate.

The cost of the car is deducted from your salary each month before you are taxed. However other pension schemes particularly defined benefit pensions - like career average schemes - will be impacted. Many people choose to salary sacrifice a car because of the tax break it provides.

Because in the eyes of the tax department youre earning less when youre salary sacrificing they tax you less. Essentially the same as what youd pay anyway but with a new clean car for a cheaper cost. Generally the car should be no older than 12 years at the end of the lease term.

That means 256555 in tax savings. With a car salary sacrifice agreement this means that Bens taxable income is reduced to 7410687. It involves using your pre-tax salary to buy goods or services that youd normally buy with your after-tax pay.

So instead of paying an estimated 1819700 in taxes Ben will be paying approximately 1563145 instead. As reported previously Salary Sacrifice schemes changed in April 2020 when the government provided further clarification around tax for fully electric hybrid and other low emission vehicles. For over 20 years weve been helping Australians salary sacrifice their way to a new car.

Because your employer is making the payments from your pre-tax salary your taxable income is less which means youll have a smaller tax bill. Salary sacrificing your next car is the smart way to lease a car. Let us begin with the basics.

Unlike company car schemes where the company pays for the car in salary sacrifice arrangements you pay for the car and it is your responsibility. In addition to price of the vehicle itself salary sacrifice car schemes usually include the essential extras that come with car ownership. Salary sacrifice car is not the same as a company car or benefit car.

The cost of the pre-tax vehicle ute he leases and car running costs are 789313 per annum. You could also save GST on the purchase price of dealership-bought cars as well as some of your cars regular running costs. Most of the benefits that can often come with a company car are included in a salary sacrifice car scheme such as road tax insurance breakdown cover servicing and maintenance.

You could also avoid paying any GST because you havent actually purchased the vehicle and the employer is leasing it on your behalf. Further increasing the attractiveness of getting a new vehicle via a salary sacrifice scheme. The primary savings come from GST and tax because the ATO allows employees to use pre-tax funds to finance a vehicle when their employer offers a salary sacrifice car scheme reducing taxable income considerably.

In essence all of the hassle organisation and effort that comes with buying a car and. A salary sacrifice car is a car you lease from a third-party supplier that has partnered with your employer. 21st January 2021.

Salary sacrificing is basically a way to minimise your tax bill. Benefits for the employer. You also have the option of sourcing the car yourself either through private sale or a dealer.

A novated lease arrangement with your employer enables you to unlock your pre-tax income which can save you thousands on your next new or used car. I am frequently asked to explain how to salary-package a car and whether the much-touted tax benefits are actually quite as generous as they are sometimes made out to be. Our service is personal.

If you know the car you want well take care of the rest. The salary sacrifice car is used as a private car but is leased by the employer usually for 36 months. This guide will take you through the latest tax rules and show you how to calculate the cost to you.

The typical way to salary package a car is by way of a novated lease which allows an employee to buy a new or used car and have their employer cover the cost of lease repayments. Whether youre in a traditional company car scheme have the option of a cash allowance or are part of an alternative scheme such as salary sacrifice its important to know exactly how much youll pay depending on the car that you choose. So if your salary was 30000 before a car salary sacrifice or any other salary sacrifice your employer will use 30000 as a reference when calculating other benefits like pension contributions.

Electric Car Salary Sacrifice Scheme Benefits Autotrader

What Is A Salary Sacrifice Car Scheme Rac

Buyer S Guide To Salary Sacrifice Car Schemes Employee Benefits

Guide To Car Salary Sacrifice Scheme Parkers

Https Democracy Harrogate Gov Uk Documents S9597 Appendix 20d 20 20salary 20sacrifice 20schemes 20report Pdf

How Can You Make Salary Sacrifice Work For Your Customers Broker News

Why Salary Sacrificing Is A Good Way To Purchase A Car Inside Small Business

Salary Sacrifice Car The Definitive Guide 2021 Easi

What Is A Salary Sacrifice Car Scheme Rac

How Can You Make Salary Sacrifice Work For Your Customers Broker News

Https Fleetworld Co Uk Wp Content Uploads 2017 11 Table Jpg

Salary Packaging Australia Car Salary Packaging Company

Salary Sacrifice Car The Definitive Guide 2021 Easi

Salary Packaging And Novated Leasing Maxxia

Businesses And Drivers Should Embrace The Company Car Fleet Alliance

Electric Car Salary Sacrifice Scheme Benefits Autotrader

Guide To Car Salary Sacrifice Scheme Parkers

Salary Sacrifice Car The Definitive Guide 2021 Easi

How Can You Make Salary Sacrifice Work For Your Customers Broker News

Post a Comment for "Salary Sacrifice Used Car"