Net Salary To Gross Uk

Use the calculator to work out what your employee will take home from a gross wage agreement. Half of the population earns less than this figure and.

Nannyplus Tax Table 2017 18 Nanny Nanny Agencies North West

Use the calculator to work out an approximate gross wage from what your employee wants to take home.

Net salary to gross uk. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. The latest budget information from April 2021 is used to show you exactly what you need to know.

2020 - salaries from 500 to 300000 currently displaying salaries from 50500 to 60000. Welcome to the Salary Calculator - UK New. To get started click any of the gross annual income amounts to see a.

To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. Your total net yearly amount after tax and NI will be 413944 and your hourly rate will be 36540 if youre working 40 hours a week as a full time employee. Please note where a net salary has been agreed the employer will be covering the employees.

Hourly rates weekly pay and bonuses are also catered for. Use our net pay calculator to work out your monthly take-home pay as a contractor or permanent employee. On the other hand your net salary is what you take home after all contributions and taxes are deducted from your gross salary.

We strongly recommend you agree to a gross salary rather than a net salary. 21 lignes The 20202021 Net Salary Calculator below outlines the net salary amount for each possible. Estimate your take-home earnings.

Updated for April 2021. How to use our Tax Calculator. Read more here about Gross vs Net.

France does not withhold income taxes from the monthly income this means that individuals have to complete an annual tax. What is the Average UK Income. According to RecruitmentBuzz to be able to start saving just 100 per month youd need a salary of 28000 or 22700 after tax.

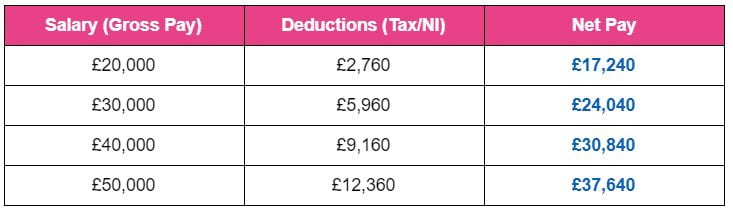

21 lignes The gross to net salary calculator below outlines the salary after tax for every level of gross salary in the UK. All calculations below are for a 30 year old male born 1st January 1991. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay.

For instance if you normally earn 1200 while 350 is taken as deductions then your gross pay will be 1200 and the net pay will be 850. You can use the net salary after tax figures to work out how much your take-home salary is after all tax and National Insurance contributions have been deducted. Multiply the net amount received by the grossing-up fraction.

Enter your annual monthly or weekly income to work out your estimated gross to net earnings after tax and pension contributions and more easily decide which working arrangement might be better for you and your. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear. The grossing-up fraction is 100 divided by 100 less the rate of tax.

Net salary is calculated when income tax and national insurance contributions have been deducted from the gross salary. Net to Gross Salary Calculator At Stafftax we strongly advocate discussing and agreeing salaries in gross terms. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save.

Its equivalent to gross pay minus all mandatory deductions. Low income earners salary less than 10084 EUR do not pay income tax but after this amount the tax grows until 45 for individuals who earn more than 158222 EUR. Post 1st Sep 2012 - Your Student Loan Repayments will be calculated at a certain percentage above a set income level - this changes depending upon the tax year For 20122013 the threshold is 21000 with 9 of of gross income above deducted.

If your income is 760008 then after tax you will be left with a net monthly take-home salary of 34495. Please click edit to adjust for. The calculation is as follows.

An employer subtracts these taxes from the gross salary as part of its payroll calculations. The amount of tax that you pay is not based on your earnings as an individual but on your earnings as a household. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear.

Through a system called Pay As You Earn PAYE the employer then remits the tax directly to HMRC on behalf of the employee. But to stand a chance of saving up for a house deposit or a good-sized investment portfolio while youre still young we think you need to be saving at least 500 a month. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Why not find your dream salary too. The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. This is because should a tax code change for any reason it will mean that you as the employer will have to bear any additional costs incurred as the gross amount would need to increase to keep the net the same.

Gross Net Salary The Urssaf Converter

72 000 After Tax Salary Uk Is 49 086 Tax Income Tax Salary

The Difference Between Gross Profit Margin And Net Profit Margin In 2021 Net Profit Profit Company Financials

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

The Difference Between Gross And Net Pay Economics Help

Net Average Monthly Salary In Europe 2017 European Map Map Europe Map

Simple Salary Slip Format Without Deductions Payroll Template Salary Schedule Template

Payslip Template Excel Online Payslip Template Payroll Template Word Template Writing Templates

105 000 After Tax Isgoodsalary

Sole Trader Bookkeeping Spreadsheet Video Video Bookkeeping Business Small Business Bookkeeping Small Business Finance

Tax Trivia If You Own A Tv In England You Pay An Annual Television Tax But If You Re Blind You Ll Only Need To Pay Half Tu Trivia Tuesday Family Fun Trivia

How To Sell Online Payslips To Your Employees Payroll Things To Sell Payroll Template

Its Proof Address From United Kingdom Uk Template File Photoshop File Photoshop Psd U Can Change Name And Address This T In 2021 Templates Electricity Photoshop

Net To Gross Salary Calculator Stafftax

50 000 After Tax 2021 Income Tax Uk

Post a Comment for "Net Salary To Gross Uk"