Salary Sacrifice Ireland

Salary sacrifice is where your employee agrees to give up some of their pay in exchange for a benefit. Annonce Payroll Employment Law for 140 Countries.

Such schemes may be subject to the salary sacrifice legislation and should be examined in relation to the.

Salary sacrifice ireland. For hourly paid employees there is no automatic reduction. The benefit must be provided by you. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France.

Taxes are deducted monthly from the. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system. Or salary sacrifice can be used to boost your pension savings while leaving your net take home income unchanged.

Cyclescheme can mangage all the administration for your company scheme Free of Charge. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month. You can save NIC of 12 of the amount sacrificed on.

However following the Budget 2011 any shares awarded under an Approved Profit Sharing Scheme including shares awarded as. En revanche lorque le salary sacrifice sinscrit dans le cadre du dispositif Cycle to Work il nest pas taxable dès lors que la valeur de lachat ne dépasse pas un montant de 1000. Full income tax relief is allowed on the amount of pay foregone.

If you use Quick Setup a new sacrifice cycle to work element and deduction will be set up. Salary sacrifice schemes may also be known as Flexible Benefits Packages or Flexi-Plans. Un salarié perçoit une rémunération mensuelle de 2500 soumise à limpôt sur le revenu et aux contributions sociales en totalité.

You and your employees can both make a saving in national insurance contributions NICs. In general the scheme will require an employee to agree to revised terms in relation to their terms or contract of employment whereby a benefit is provided in return for a reduction in take-home pay. Salary Foregone also known as Salary Sacrifice is a Revenue approved employee share plan linked to the Profit Share scheme which allows you to forego an element of pay to purchase additional Diageo shares.

Salary sacrifice can be useful in the following ways. Its a tax-efficient way to make extra contributions to your pension and both you and your employer will pay lower National Insurance Contributions on your reduced salary. Salary sacrifice allows you to give up some of your salary so you can claim extra benefits from your employer.

Make sure you are locally compliant with Papaya Global help. Salary sacrifice can be used to boost pension savings. Salary sacrifice Example Employees can reduce their gross salary by the cost of their chosen ticket and will therefore reduce the taxable element of their salary.

Dans le cadre du dispositif Cycle to Work l. Their pay will still have to be manually adjusted. This manual outlines the general tax treatment for Salary Sacrifice ArrangementsThe term salary sacrifice is generally understood to mean an arrangement under which an employee forgoes the right to receive any part of his or her remuneration due under his or her terms or contract of employment and in return his or her employer provides a benefit of a corresponding amount to the employee.

Your employees can save up to 52 on a bike and safety accessories by joining the Cycle to Work scheme. A salary sacrifice agreement is entered into in respect of any right bonus commission or any other emolument which arises to an individual after the end of the year of assessment concerned. The reduction must be effected by.

Employee earns 30000 Gross Salary Annual ticket costs 1800 and is deducted from their Gross Salary. In broad terms an employer pension contribution to a pension scheme for that employee is not salary sacrifice if it is not funded by the employee foregoing an equivalent amount of remuneration due under their contract of employment. An example of a salary sacrifice is where your employee gives up some of their pay for a travel pass.

This arrangement means that there will be a change to the terms and conditions of. A benefit which would have otherwise qualified for an exemption under section 118B2a is provided to the spouse civil partner or a person connected with the individual. Salary sacrifice can be used to maintain your level of pension savings and see an increase in your net take home income.

Suite du sacrifice de lIrlande Intervention UE-FMI En avril 2010 suite à une augmentation des rendements obligataires irlandais 2 ans lagence nationale NTMA National Treasury Management Agency déclare quil ny a aucune obligation de refinancement significatif en 2010Lexigence de 20 Md pour lannée a été compensée par un solde de trésorerie de 23 Md. Typically the salary is sacrificed in exchange for a benefit which is nontaxable such as pension contributions. You will save 138 of the amount sacrificed in NICs while your employees will save between 2 and 12 of the amount they sacrifice depending upon their earnings.

For salaried employees the salary amount will automatically be reduced by the sacrifice amount. Global salary benchmark and benefit data. A tax exemption exists for certain salary sacrifice arrangements.

If you want Cyclescheme to run your Cycle to Work scheme or take over your current scheme please sign up below.

Sse Republic Of Ireland Your Benefits Welcome Your Republic Of Ireland Employee Benefits Booklet Provides Details Of The Extensive Range Of Benefits Ppt Download

![]()

Coronavirus Income Supports For Employers And Employees In Ireland

Https I2 Prod Irishmirror Ie Incoming Article24232892 Ece Alternates S1200d 1 Scamexamplespng Png

Salary Sacrifice Cycle To Work Scheme Off 60 Medpharmres Com

Job Being Advertised With No Pay In Ireland But You Do Get A Free House Irish Mirror Online

Too Long A Sacrifice Maternal Mortality In Northern Ireland During The First Half Of The 20th Century Cairn International Edition

Https Www Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 05 05 03 12 20180820092737 Pdf

2021 Ireland Calendar With Holidays Printable In 2021 2021 Calendar Printable 2021 Printable 2021 Calendar

How To Maximise The Benefit Of The End Of Year Bonus

Too Long A Sacrifice Maternal Mortality In Northern Ireland During The First Half Of The 20th Century Cairn International Edition

Circle K Ireland Retail Cycle To Work Scheme Cyclescheme Ie

National Anthem Of Myanmar With New Flag Coat Of Arms Youtube Coat Of Arms National Anthem Flag

Cyclescheme Ireland Home Facebook

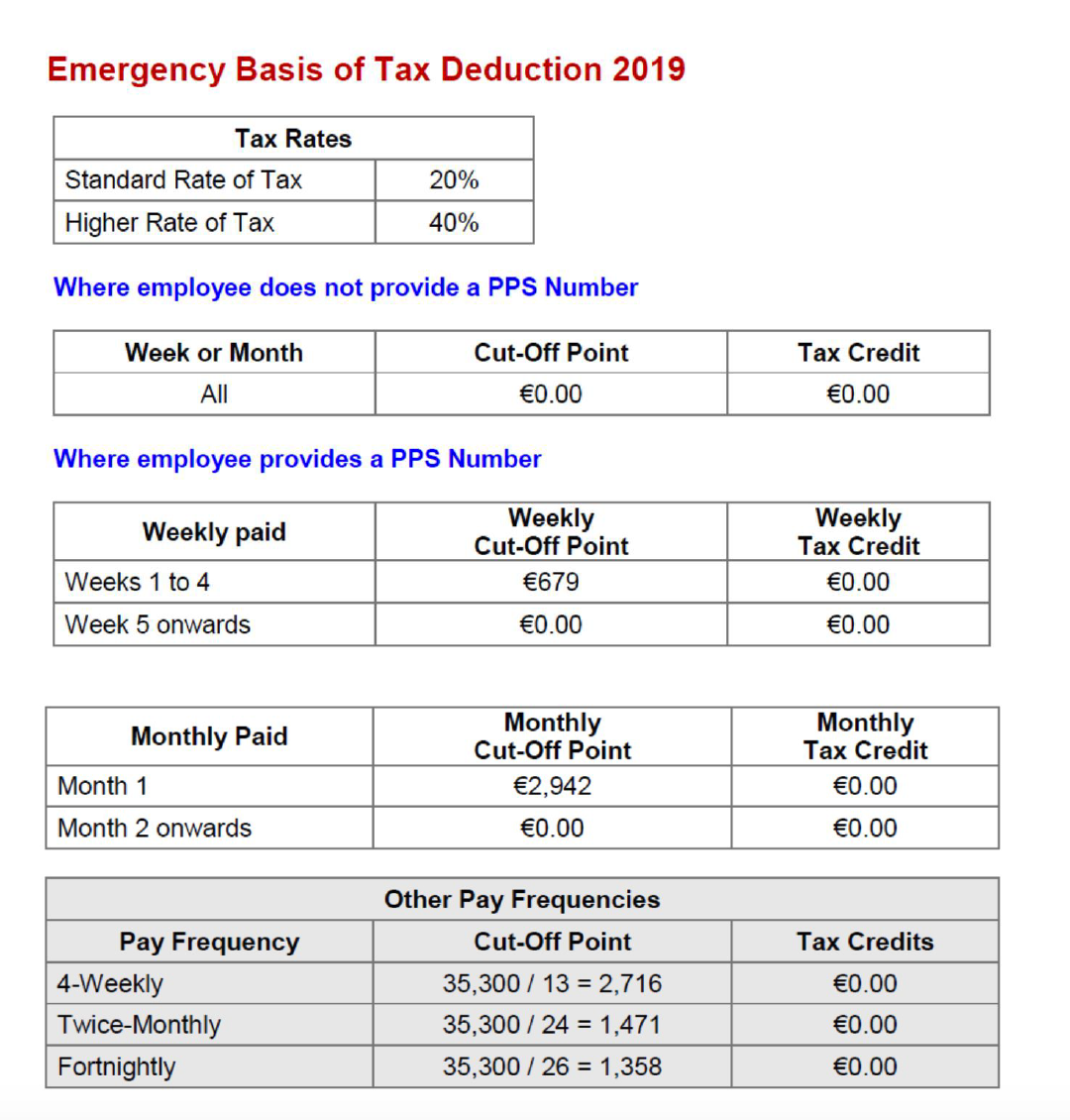

Paye Pay As You Earn Brightpay Documentation

Https Www Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 05 05 03 12 Pdf

Post a Comment for "Salary Sacrifice Ireland"