Zurich Salary Sacrifice

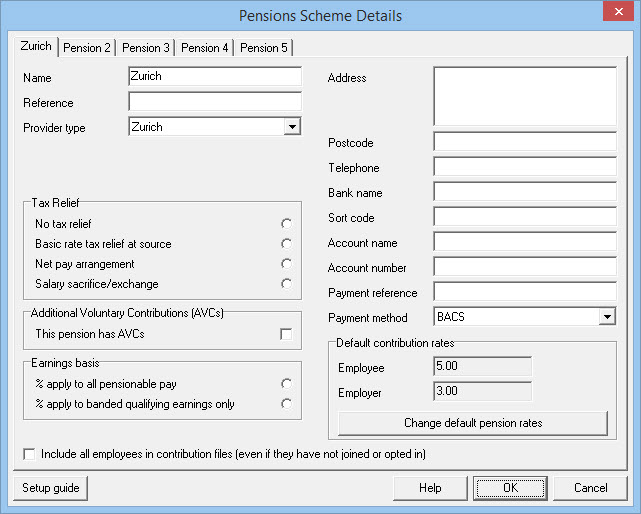

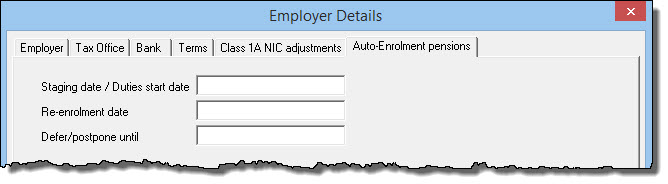

If you have taken specialist advice and have decided to use a salary sacrifice scheme which meets HMRC requirements and complies with. Providing your salary sacrifice scheme is set up correctly the main benefit to both employer and employee is a reduction in NICs.

Check with your employer to see which salary sacrifice schemes are on offer if any.

Zurich salary sacrifice. The average Zurich Insurance salary ranges from approximately CA153822 per year for an Underwriting Specialist to CA153822 per year for an Underwriting Specialist. Salary sacrificeexchange-Salary sacrifice is an arrangement where a worker agrees to give up part of their salary and in return their employer pays it into their pension pot as part of their employer contributions. Your average tax rate is 168 and your marginal tax rate is 269.

I hereby apply to the Trustee of the Zurich Insurance-only Superannuation Plan of the Aon Master Trust to change the contribution type for. Because of this the worker receives a lower salary. This year a salary sacrifice review will be essential.

Virtual GP for family members new option to add partners and children Gadget insurance - Up to 2000 of annual cover gives employees peace of mind that should anything happen their gadget will be repaired or replaced. Work out the maximum benefit your client should apply for under a Zurich Income Protection Policy when selecting dual deferred periods. Employer contributions compulsory andor voluntary Salary Sacrifice contributions Personal contributions Self-employed contributions Spouse contributions Rollovers or transfers from other funds Downsizing contributions.

If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399. Also you may be eligible to. Before setting up a salary sacrifice arrangement you should take advice on the potential advantages and disadvantages to help you evaluate any salary sacrifice arrangement available to you.

Contributions to be paid into including the Zurich Superannuation Plan. The Zurich Master Superannuation Fund accepts. Salary sacrifice options vary as employers must choose to opt into a scheme.

Car park season tickets refunds for all employees until the offices open again completely at Zurichs expense Option to reduce pension salary sacrifice for the year Option to sell holiday back to the company The provision of additional free office equipment to ensure safe. Ending salary sacrifice on pensions would be a blow to people on all incomes and would disproportionately hit basic rate taxpayers who the Government should be encouraging to save more Pension scams. This is in addition to the usual tax relief available on pensions and so helps to make.

Like regular superannuation contributions salary sacrifices are taxed at 15 per cent when they are paid into the fund. If you are interested in salary sacrifice you should discuss this further with your employer and your financial adviser. Provider Zurich has warned ahead of the Budget that savers on lower incomes would be disproportionately hit by a move to abolish salary sacrifice for pension.

If you are interested in salary sacrifice you should discuss this further with your employer and your. That means that your net pay will be CHF 41602 per year or CHF 3467 per month. Contributions pre-tax contributions Your employer may be willing to make contributions to your superannuation account as part of your total remuneration package instead of to you as salary.

Zurich is also launching five new additional new benefits for UK based employees available through salary sacrifice. Zurich Insurance employees rate the overall compensation and benefits package 385 stars. Salary sacrifice Salary sacrifice pension arrangements involve you giving up part of your salary and your employer making additional payments into your pension plan.

Salary Sacrifice Non-concessional contributions Personal Self-Employed Spouse Other please specify 3 Declaration Please read and complete the following. Employers will save 138 on the amount of salary sacrificed and employees will save either 12 or 2 or somewhere in between if their sacrifice spans the upper earnings limit. Such an approach can be far more attractive than the employee making a direct pension contribution on hisher.

Salary sacrifice We welcome the Governments decision to exempt pensions from the new taxation rules on salary sacrifice schemes. Options include running dual arrangements closing access to certain benefits post-April and a number of other alternatives. Salary sacrifice contributions pre-tax contributions Your employer may be willing to contribute some of your remuneration package directly into your ZSP account instead of paying it as salary.

In addition employees may also choose to make voluntary contributions into super either from their after-tax income or they can arrange with their employer to salary sacrifice some of their pre-tax salary into superannuation. You can increase your superannuation through a salary sacrifice. You must fit in time for a salary sacrifice review.

Salary Sacrifice is where an employee sacrifices part of their salary andor bonus in return for their employer paying the amount sacrificed as an employer pension contribution on their behalf. Salary sacrifice is commonly used to boost your pension but you can also give up salary in return for benefits such as bikes mobile phones and bus passes. This is where your employer takes part of your pre-tax salary and pays it directly into your superannuation account.

The first quarter is usually busy enough as it is for HR professionals with appraisals and salary and bonus reviews to contend with. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Https Www Ft Com Origami Service Image V2 Images Raw Https 3a 2f 2fs3 Eu West 1 Amazonaws Com 2ffta Ez Prod 2fez 2fimages 2f6 2f3 2f9 2f7 2f1767936 1 Eng Gb 2fzurich Logo Jpg 3fv1 Width 700 Source Ftadviser

Zurich Teams Up With Thomsons Online Benefits To Deliver New Reward Proposition For Uk Employees 2018 Zurich Insurance

Policies For Switzerland S Ageing Society Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

Tools And Guides Zurich For Intermediaries

Swiss Winter Visit Zurich Switzerland Tourism Zurich Tourism

Zurich Und Die Alpen Panoramic View Vintage C 1910 Etsy Panoramic Views Panoramic Alpen

Clerical Jobs Employment In Sacramento Ca Indeed Com In 2020 Admin Jobs Clerical Jobs Job

Why Zurich Switzerland Is A Great City For A Us Expat

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

Zurich Introduces Fully Paid Emergency Lockdown Leave For Parents And Carers 2021 Zurich Uk News

Https Www Zurich Com Au Content Dam Au Documents Personal Life Insurance Forms Contribution Advice Zurich Insurance Only Superannuation Plan Form Pdf

Thinking Of A Solo Adventure In Switzerland Here S Why Zurich And Geneva Are Solo Travel Travel Voucher Travel Switzerland

Issue Of Chf 250m 1 875 Fixed Rate Notes Due 2017 Adecco

Post a Comment for "Zurich Salary Sacrifice"