Gross Monthly Income Calculator Texas

According to theTexas Child Support Calculator to calculate the net monthly income the court first calculates the gross income annually and then recalculates it to determine the average income each month. It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount.

Texas Child Support Calculator 2012 Iphone And Ipad App By Vernerlegal Genre U Child Support Calculator Ideas Of Child Supportive Calculator App Children

Texas Real Estate.

Gross monthly income calculator texas. And if you live in a state with an income tax but you work in Texas youll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state. Calculate Monthly Gross Income Do you need a fast Pre-Qual. Gross monthly wage refers to your monthly paycheck before taxes and other deductions.

This calculator does not calculate support in excess of the 9200 net resource amount per Texas Family Code sec. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Taxable Income in Texas is calculated by subtracting your tax deductions from your gross income.

Gross Monthly Income Calculator. 256 lignes How Income Taxes Are Calculated. Your average tax rate is 169 and your marginal tax rate is 297.

Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inTexas the net effect for those individuals is a higher state income tax bill in Texas and a higher Federal tax bill. See how your monthly payment changes by. This Texas State State tax calculator aims to balance ease of use with transparency of tax calculation but is provided for illustration only.

Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than 9200. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

Alternatively you can choose the advanced option and access more detailed inputs which allow you. Projected Monthly Child Support Obligation for net resources up to 9200. We acknowledge that in Todays housing market it is very HOT and new listings go under contract just.

The Texas State State tax calculator is as good as the feedback your support requests and bug catches help to improve the accuracy of the tax calculator for all. Gross monthly income or gross pay for an individual is their full payment of work before taxes and other deductions. Remember that you should always seek professional advice and audit your State and Federal tax returns.

Monthly Gross Income Calculator Mortgage Payoff Calculator Calculate The Monthly A Mortgage Refinance Calculator. It means the annual net incomeresources divided by 12 to give the monthly net resources. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Gross monthly income calculator texas. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Individuals calculate their gross income as total wages before deductions. The texas salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2021 and texas state income tax rates and thresholds in 2021. Use this Texas gross pay calculator to gross up wages based on net pay.

Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year. This is great for comparing salaries reviewing how much extra you will have after a pay rise or simply keeping a quick eye on your tax withholdings. After a few seconds you will be provided with a full breakdown of the tax you are paying.

For instance an increase of 100 in your salary will be taxed 3613 hence your. Sources of gross. Alternatively gross monthly income for businesses also called gross margin or gross profit is the culmination of all company revenue minus the cost of goods sold COGS.

Check out the Texas Workforce Commissions website to find your current tax rate. First we calculate your adjusted. Federal Filing Status.

The tax calculator can be used as a simple salary calculator by entering your Monthly earnings choosing a State and clicking calculate. Money online Tutorial March 11 2021 February 20 2021. In todays competitive market we understand the urgency of your pre-qualification.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. That means that your net pay will be 45705 per year or 3809 per month. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Net salary 57 829 2 100 2 300 net salary 57 829 4 400. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator. Your tax rate is calculated using several factors and can change each yearthe minimum tax rate is 036 and the maximum rate is 636 in 2019.

To use our Texas Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Payroll taxes in Texas are relatively simple because there are no state or local income taxes.

How To Calculate Gross To Net Pay Financial Documents Calculator Federal Income Tax

Gross Pay And Net Pay What S The Difference Paycheckcity

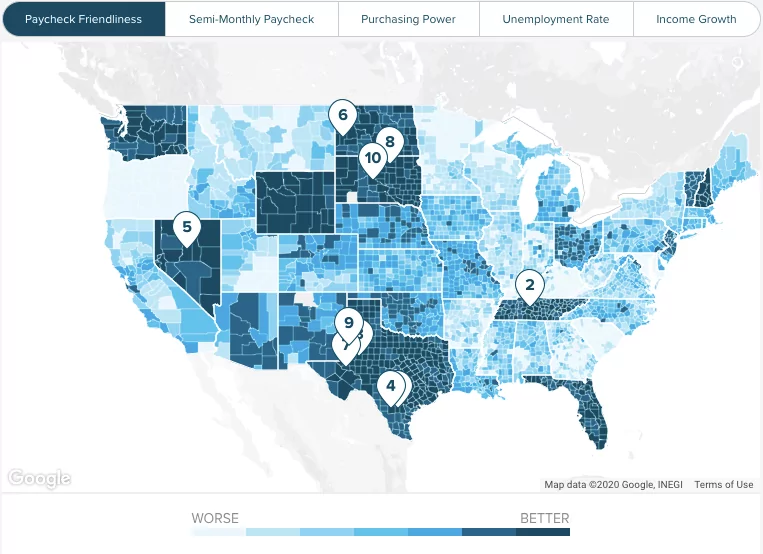

Texas Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Irs Transcript Codes And Meanings Good Faith Estimate Coding Meant To Be

Texas Paycheck Calculator Smartasset

Gross Annual Income Calculator

How To Calculate Monthly Sales Tax For A Restaurant Sales Tax Making A Business Plan Income Tax

4 Ways To Calculate Annual Salary Wikihow

Pin On Our Home Loans Houston Online

Paycheck Calculator Take Home Pay Calculator

Hp 10bii Financial Calculator Easy Amortization Calculator Tips Of Paying Of Mortgage Calculator In Mo Mortgage Calculator Calculator Financial Calculator

Mortgage Calculator Mortgage Calculator Mortgage Mortgagesforselfemployed Calculate Your Month Online Mortgage Mortgage Amortization Mortgage Loan Originator

Texas Paycheck Calculator Smartasset

Calculating Gross Pay Worksheet Home Amortization Spreadsheet Watchi This Before You Apply Your First Va Loan Student Loan Repayment Spreadsheet Worksheets

Mortgage Calculator Calculate Your Monthly Mortgage Payment Mortgage Calculat Mortgage Amortization Calculator Mortgage Amortization Mortgage Loan Calculator

How To Calculate Dti For Fha Loan Debt To Income Ratio Fha Loans Loan Lenders

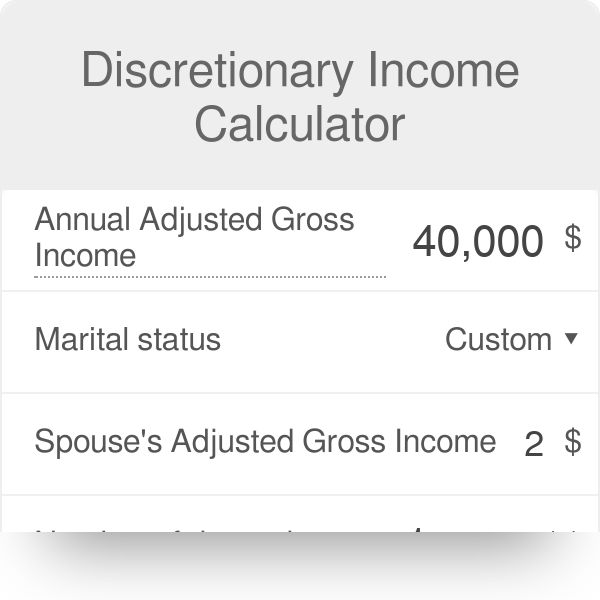

Discretionary Income Calculator

Post a Comment for "Gross Monthly Income Calculator Texas"