Military Retirement Pay Calculator Sbp

Military retired pay stops upon the death of the servicemember. The Survivor Benefit Plan is a Department of Defense sponsored and subsidized program that provides up to 55 percent of a service members retired pay to an eligible beneficiary upon the death of the member.

How To Calculate The Value Of A Guard Reserve Retirement Military Guide

The Survivor Benefit Plan SBP is a program through which the Department of Defense provides monthly cost-of-living-adjusted income to eligible survivors of Soldiers who die on Active Duty in the line of duty including Reserve Soldiers and National Guard Soldiers who die on Federal Active Duty in the line of.

Military retirement pay calculator sbp. In this case we would calculate 65 percent of 700 and the monthly cost to cover a spouse under SBP would be 4550. Annuity amount if retiree died before May 1 2010 262500 - 1182 261318 x 055 143725 rounded down to 143700 Annuity amount if retiree died on or after May 1 2010 262500 x 055 144375 rounded down to 144300. This change will benefit retirees and their survivors by preventing a debt when a retiree forgets to pay the SBP premiums directly.

Depending on an individuals situation provisions of the program may include coverage of tuition and fees a monthly housing allowance a books and supplies stipend Yellow Ribbon payments college fund rural benefit. When SBP premiums are not paid during a retirees lifetime it creates a debt which must be repaid from the SBP annuity a survivor receives. Premiums are paid from gross retired pay so they dont count as income.

If the base amount was greater than or equal to 1554 the formula in 1 was used. In most cases costs to participate are deducted from the retirees monthly pay and are based on the amount of. For base amounts less than 1554 the formula in 2 was used.

At retirement full basic SBP for spouse and children is automatic if. This means less tax and less out-of-pocket costs for SBP. You can also elect a lower level of SBP coverage.

There is however a minimum level of coverage required and that the amount is unique to. This is the first widely-available calculator that allows Reservists to estimate their non-regular retired pay. The Department of Defense has introduced a new legacy High-3 Retirement Calculator to help members Active Duty and Reserve under the high-3 retirement system to estimate their retired pay.

The Survivor Benefit Plan SBP Reserve Component Survivor Benefit Plan RC-SBP or Retired Servicemans Family Protection Plan RSFPP allow you to leave an ongoing monthly income to someone you love. Military pay including active duty pay and allowances and retired pay stops upon a Soldiers death. You may elect SBP based on your full gross retired pay or on a reduced base amount from 300 to full retired pay.

For example if you receive 1000 of retired pay each month you can elect to have your coverage based only on 700 of your pay. Military Retirement Calculators The Department of Defense uses a multi-step formula to compute your retired pay. SBP allows for a part of that retired pay to continue to a survivor.

This can be up to but not more than 65 percent of gross retired pay. The add-on premium depends on three things. DFAS is now deducting SBP recurring monthly premiums from CRSC pay.

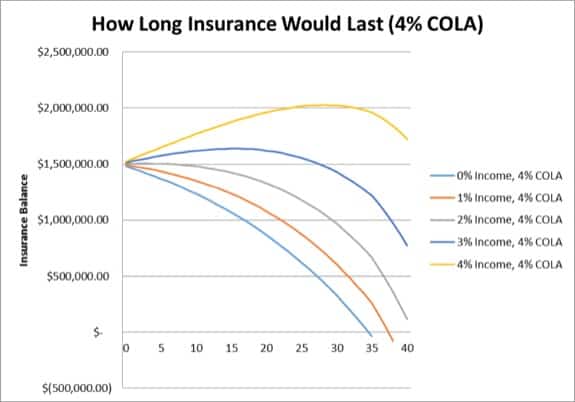

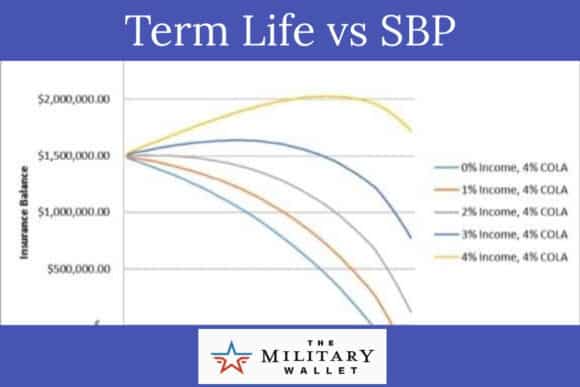

In addition active duty members can purchase coverage upon retirement. The next table shows what can happen after retirement when inflation is 4 percent per year. The Post-911 GI Bill chapter 33 benefits is an education benefit program specifically for military members who served on active duty on or after September 11 2001.

The SBP costs used in column 2 are calculated using the formula that provides the least cost. If you are enrolled you will pay premiums for your SBP coverage. This deduction began with the April 2018 CRSC entitlement paid on May 1 2018 for SBP.

Election to participate in these programs is generally made at the time of retirement although some situations allow a retiree to add coverage after retirement. The SBP annuity is calculated at 55 percent of what the Soldiers retired pay would have been if the Soldier had retired with a 100 percent disability on their date of death after first subtracting. Allows you to leave your final months pay and any other money owed to you at the time of your death to a beneficiary Annuity Coverage.

In addition you can only leave an annuity to eligible beneficiaries. The cost for spouseformer spouse and children coverage is based on your age the age of your spouseformer spouse and the age of your youngest child from the marriage. How add-on cost is calculated The Office of the Department of Defense Actuary provides the tables used to calculate RCSBP premiums.

While service members are on active duty they are provided with SBP coverage at no cost. On January 1 2010 the breakeven point between the two formulas was 1554. Arrears of Pay AOP.

SBP provides a monthly annuity increasing with the Cost of Living Adjustment COLA for your eligible beneficiaries. When you retire you may be able to elect any of several SBP options which are listed below. Factors such as the year you entered service and your retirement type also affect your pay.

The tables reflect military death rates remarriage and divorce rates and other estimates. Plan for retirement by viewing personalized retirement reports performing what-if exercises to see how your benefits might change and reviewing related fact sheets. SBP elections cannot be canceled or changed after retirement except in specific instances such as a change in your marital status or after the loss of a beneficiary.

For a surviving spouse that benefit may be for life. A military retiree pays premiums for SBP coverage upon retiring. However once a service member has retired a deduction is taken from their retirement pay each month to pay for SBP coverage.

The program provides no-cost automatic coverage to members serving on active duty and reserve component members who die of a service connected cause while performing inactive duty training. This worksheet will assist you in estimating the monthly premium cost for your SBP coverage for spouseformer spouse andor children. SBP premium 158 Add-on cost 1182 Total deducted from Retired Pay 1340.

The premium increases with retired pay cost-of-living adjustments. The amount generally is based on your length of service or your disability percentage.

Military Retirement Calculator High 3 Redux Early Retirement Final Pay With Cola Cost Of Living Allowan Retirement Calculator Early Retirement Cost Of Living

Term Life Insurance Vs Survivor Benefit Plan Sbp A Comparison

Survivor Benefit Plan Sbp Va Org

Military Compensation Pay Retirement E7with20years

Dod Launches Blended Retirement System Comparison Calculator United States Coast Guard Pay And Personnel News

Military Retirement Calculators Military Benefits

Military Compensation Pay Retirement W3with22years

How Not To Calculate Military Retirement Pay Us Vetwealth

How Not To Calculate Military Retirement Pay Us Vetwealth

How To Retirement Pay For E7 With 20 Years Us Vetwealth

Term Life Insurance Vs Survivor Benefit Plan Sbp A Comparison

Plan Alfabetizare Haine Survivor Benefit Plan Calculator Callumluckwellfinalyear Com

Navy Reserve Military Retirement Pay Calculator Shrewdness Of Armed Departure Answer For Shares

Military Compensation Pay Retirement E7with20years

How Not To Calculate Military Retirement Pay Us Vetwealth

Https Militarybenefits Info Military Retirement Calculators

Military Compensation Pay Retirement E9with30years

Download Military Money Free For Android Military Money Apk Download Steprimo Com

Post a Comment for "Military Retirement Pay Calculator Sbp"