Salary Sacrifice Into Super For First Home Buyers

This will help first home buyers save faster with the concessional tax treatment of superannuation. Total super contribution SG salary sacrifice 8500.

A Millennial S View Federal Budget Changes 2017

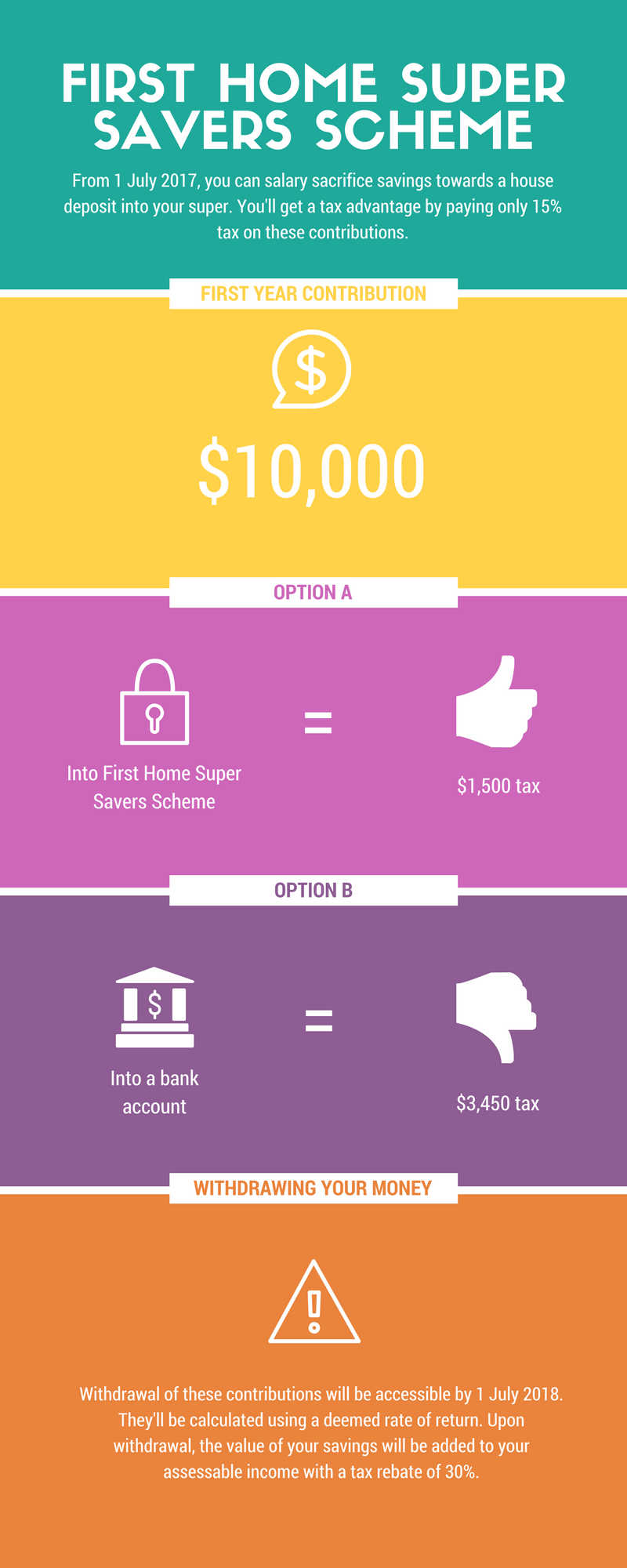

1 An overview of how the scheme works The new First Home Super Saver FHSS scheme allows you to voluntarily contribute up to 30000 to your super and withdraw this amount plus earnings less tax.

Salary sacrifice into super for first home buyers. Total take home pay and. This is an increase from a previous limit of 30000 in acknowledgement that house prices have soared. This was increased from a maximum of 30000 previously.

The help comes in the form of the First Home Super Saver Scheme which lets potential buyers save up to 50000 through their superannuation accounts towards their property purchase. Its especially good for first home buyers who can withdraw up to 30000 in voluntary super contributions as well as the amounts earnings to put towards their first home. Say youre earning 130000 a year and you decide to make additional salary sacrifice contributions of 10000 into your superannuation.

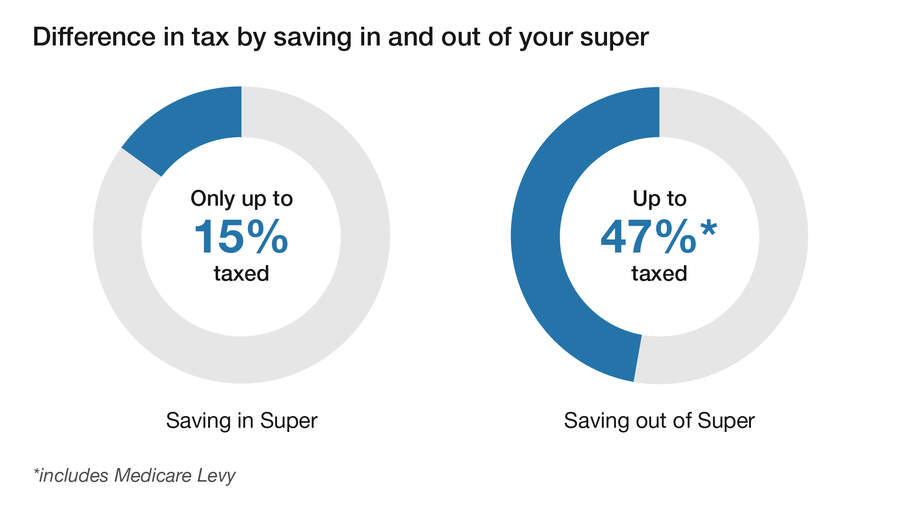

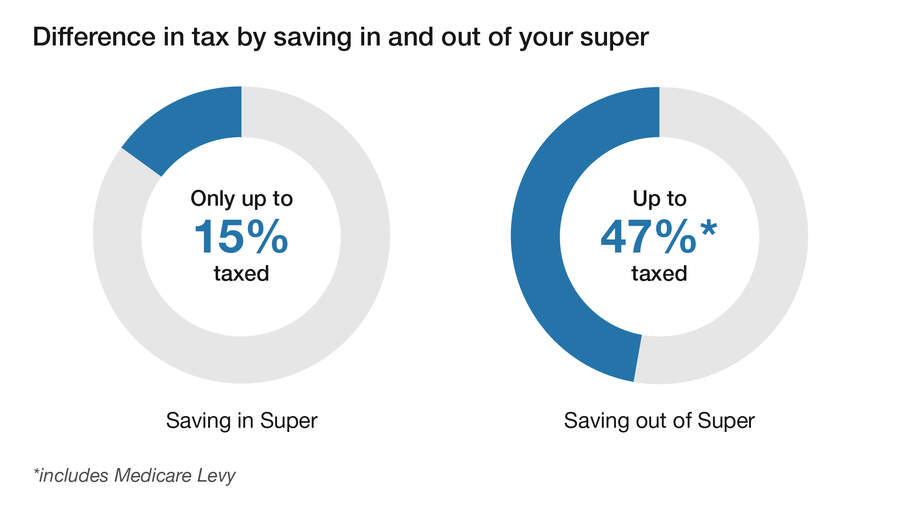

Its all about the tax. Sallys salary sacrifice contribution of 15000 will reduce her take-home pay by only 9650 and after 2 years she will have an estimated 25355 available for deposit under the First Home Super Saver Scheme. Undeducted non-concessional personal contributions.

Imagine you earn 80000 and decide to salary sacrifice 10000 to super. The First Home Super Saver scheme allows you to save money in your super for a deposit to purchase your first home. Under the governments First Home Super Saver Scheme first home buyers can withdraw up to 30000 in voluntary super contributions to buy their first home.

First home super saver scheme. On 9 May 2017 the Government announced that from 1 July 2018 individuals will be able to apply to withdraw voluntary contributions made to super after 1 July 2017 for a first home. Your contributions are taxed at a much lower rate than your income is so you get to keep more of your money.

Usually you can salary sacrifice for home loans only if you plan to live in the house yourself and not if youre buying property for investment purposes. The Government announced in its 2017 budget that first home buyers will be able to salary sacrifice some of their income into their superannuation to be used as a deposit for a home. Even homebuyers planning to become owner-occupiers may find many lenders unwilling to accept a salary sacrificing arrangement.

Deducted concessional personal contributions. Again the employer may prefer that you salary sacrifice to your super fund. Super contributions tax 15 x super contribution amount 1275.

This is called the First Home Super Saver Scheme. For example if you earned 75000 a year and salary sacrificed 10000 a year into a First Home Savers Account it would reduce your taxable income by 10000 meaning you would only pay income tax on 65000. It works like this.

The advantage of salary sacrificing is that it reduces your taxable income and therefore puts more money in your pocket. Salary sacrificing into super may also help you save for your first home. According to the ATO Australian Taxation Office first home buyers can contribute a maximum of 15000 in any one financial year to the FHSSS scheme and a maximum of 50000 per person overall as of 2021.

The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. The scheme aims to make it easier to buy or build your first home but there are rules around who can use the FHSS and when you can get your money out. The FHSS scheme allows you to save money for your first home inside your super fund.

This would include any salary sacrifice contributions and the associated earnings. When your salary sacrifice contribution arrives at your super fund it will be taxed at 15 per cent. After three years you will have an estimated 24777 available for your deposit under the First Home Super Saver scheme.

It lets you contribute extra money to your superannuation and then access that money as part of a down payment for your first home. That is 5802 more than Sally would have had if. This points to why the First Home Super Saver Scheme makes sense.

So taking the 500 example earlier after tax is deducted 425 hits your super fund. The First Home Super Saver FHSS Scheme allows first home buyers to make contributions to their super then withdraw those contributions for a deposit to buy or build a home to live in. Check with your lender.

The scheme taps into supers tax breaks to give your deposit a healthy boost. If she salary sacrifices 6000 into her super she will be 1170 better off after-tax and she will also have more savings in her super account. Under the FHSSS first home buyers who make voluntary super contributions of up to 15000 per financial year into their super can withdraw these amounts in addition to associated earnings less tax from their super fund to help with a deposit on their first home.

The First Home Super Saver Scheme was introduced to help some first home buyers save a deposit faster.

Epingle Sur Deco Par Piece Decor By Room

First Home Loan Deposit Scheme Extended

Https Www Ngssuper Com Au Files Forms Download Fhss Info Sheet Pdf

First Home Super Saver Scheme Bt

Babysocken Stricken Kostenlose Anleitung Caros Fummeley Sunken Living Room Living Room Decor Colors Modern House Design

First Home Super Saver Scheme Step By Step Guide Fhsss Tips

First Home Super Saver Scheme Step By Step Guide Fhsss Tips

12 Personal Finance Tips And Tricks To Make You Rich Swift Salary Personal Finance Money Management Advice Finance Tips

How First Home Buyers Can Use Salary Sacrificing To Buy A House

First Home Super Saver Scheme Fhss

The First Home Super Saver Scheme Can Boost Your Deposit Here S How To Use It Abc Everyday

First Home Buyers Able To Save With Super

Now Save Even More For Your First Home Aware Super Australian Superannuation Fund

Saving For Your First Home Cbus Super

First Home Super Saver Scheme Step By Step Guide Fhsss Tips

What You Need To Know About The First Home Super Saver Scheme Tax Accountants Springvale Tax Store

First Home Super Saver Scheme Expert Guide Mozo

50 000 To Be Permitted In First Home Super Saver Scheme Withdrawals Urban

Using Your Super Fund To Save For Your First Home Nab

Post a Comment for "Salary Sacrifice Into Super For First Home Buyers"