Net Salary Uk Gov

For example for 5 hours a month. Get P45s and P60s for your employees if you cannot produce these using your payroll software.

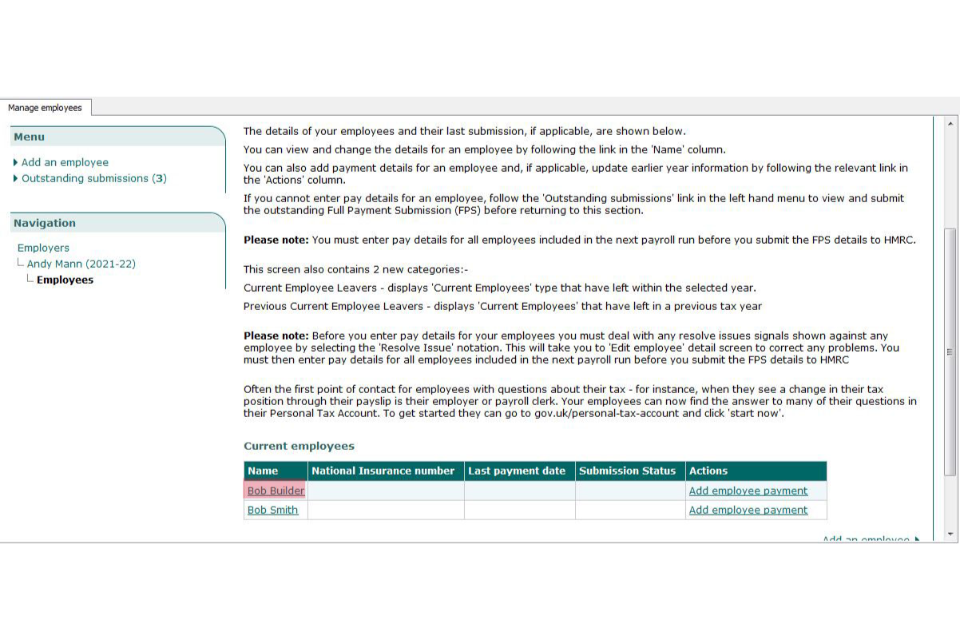

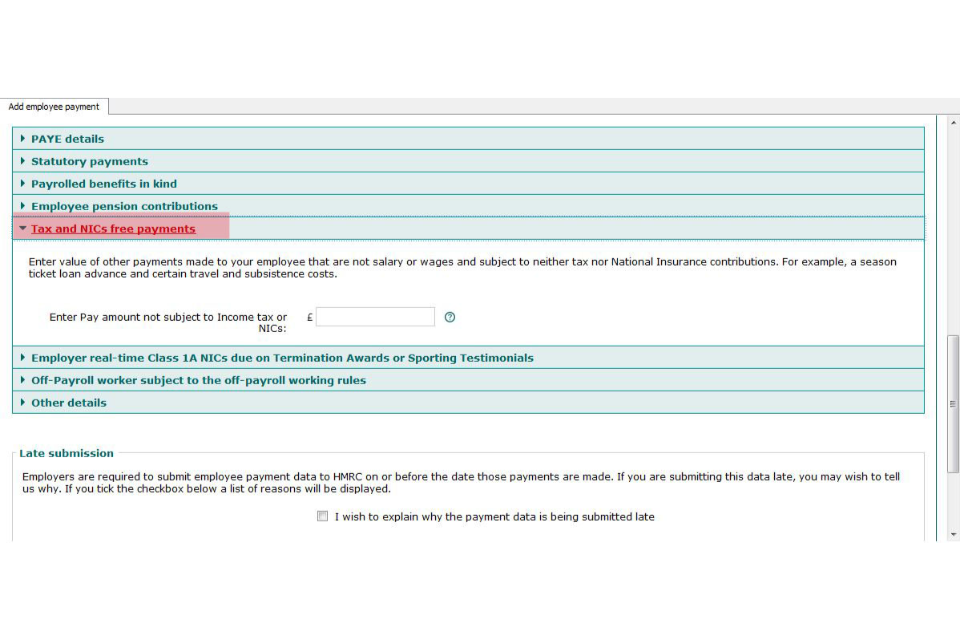

Basic Paye Tools User Guide Gov Uk

PAYE National Insurance contributions current year reference checker.

Net salary uk gov. You do not need to calculate your weekly pay if youre paid weekly and your pay does not vary. This website portal is. This equates to an annual salary of 29900 annually although it should be noted that this figure represents the.

The NMW applies to employees aged between 16 and 24 years. It is common for someone working in CIS to be earning below the threshold for higher rate tax so they have some adjustments to make at the end of the tax. 872 if over 25 820 21-24 years old 645 18-20 years old 455 for under 18 years old and 415 for apprentice.

Any individual employee having an employee ID code can easily access. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Updated for April 2021.

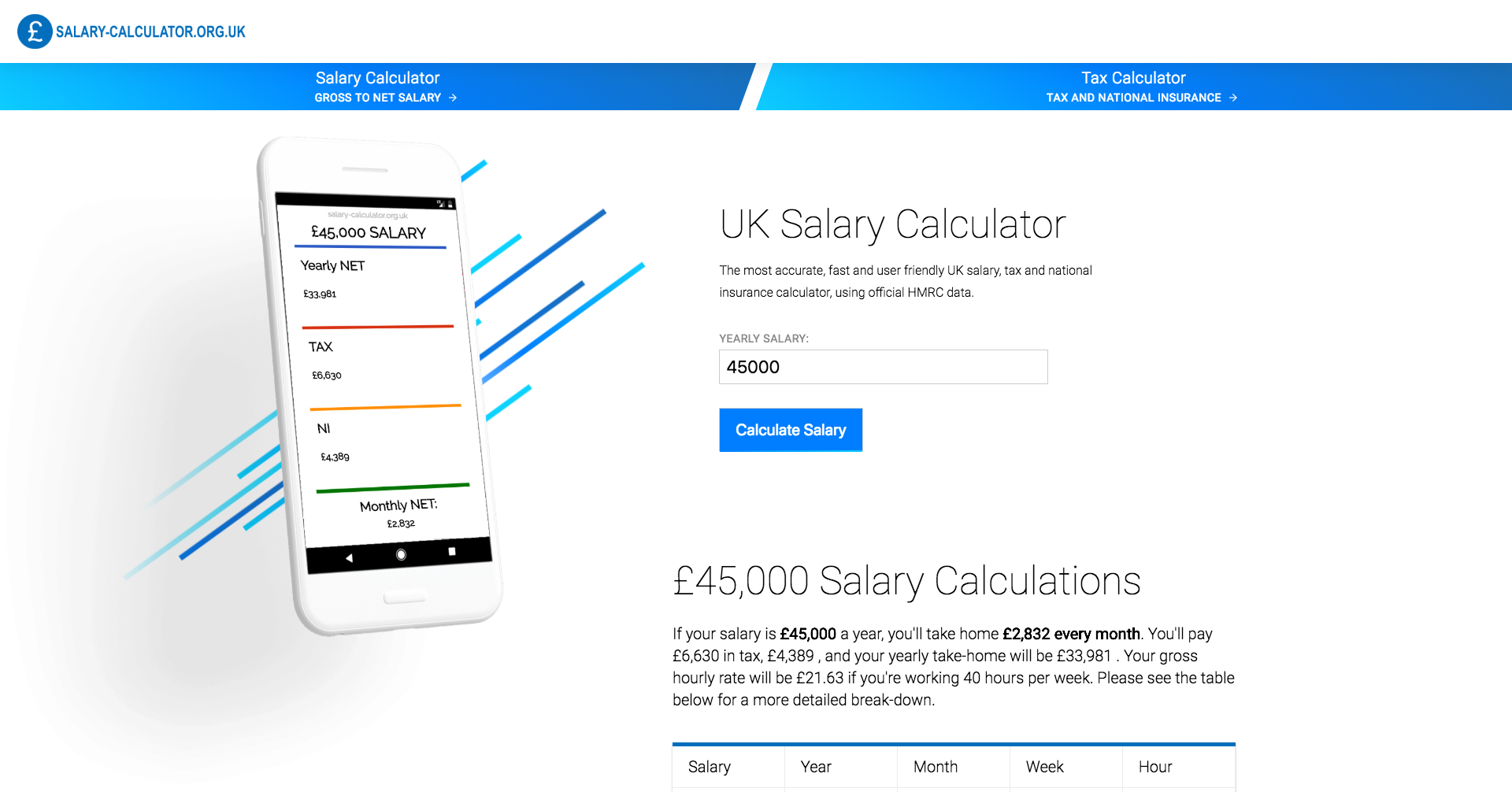

We have published guidance to help employers calculate the grant available under the CJRS. Your gross hourly rate will be 2163 if youre working 40 hours per week. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

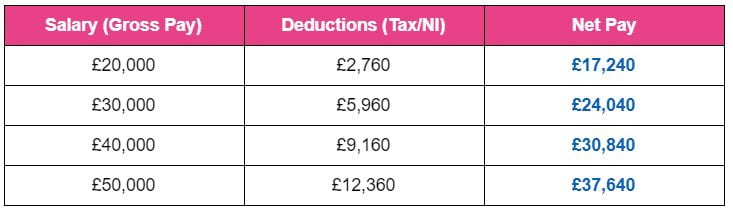

Please see the table below for a more detailed break-down. If your pay varies or youre not paid. The governments National Living Wage NLW was introduced on 1 April 2016 and applies to employees.

Check what the National Minimum Wage is for different ages. Your employer can take 10 of your gross earnings which is 25. Youre paid 250 gross per week.

They must only take 25 one week and then make another deduction from your next pay cheque. The National Minimum Wage NMW is a minimum amount per hour that most workers in the UK are entitled to be paid. Find out the benefit of that overtime.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Estimate your Income Tax for the current year. Gross salary vs your net pay Chances are youll already know what your gross salary is the total amount youre paid for the work you do each year.

People within CIS receive regular payments from the contractor they work for however these payments are made net of basic rate tax effectively all pay has a flat 20 percent taken off at source with no regard for personal tax free allowances. Any person interested in having the same has to complete the entire registration process and log onto their related account for the same. Your net wage is found by deducting all the necessary taxes from the gross salary.

Enter the number of hours and the rate at which you will get paid. Agree a contract and salary When someone accepts a job offer they have a contract with you as their employer. Your take home pay otherwise known as net pay is the amount you receive each month after any deductions which have to be made like Income Tax and National Insurance.

All it takes the user is that he she has to complete the online registration process and log in to their self accounts. If your salary is 45000 a year youll take home 2853 every month. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own.

The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. Employers can claim up to 80 grant for the hours not worked by an employee up to a maximum of 2500 a month. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

This 2500 cap applies to the employees gross pay. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. In this new effort the UK Employees can now have the opportunity to view their own monthly salary directly as a soft or hard copy from the site using the link wwwekoshukgovin.

Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear. There are different rates of minimum wage depending on a workers age and whether they are an apprentice. The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere.

The entire UK Employees can view their own monthly salary directly from the website using the link wwwekoshukgovin. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save. The average salary in the UK is 29600 per year or 1950 per month.

Net Pay 201920 Net Pay 202021 Difference. All the employees have an employee ID code that helps them access the portal whenever and wherever they want according to their comfort. Welcome to the Salary Calculator - UK New.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. The 20202021 UK minimum wage National Living Wage per hour is currently. Use the calculator to work out what your employee will take home from a gross wage agreement.

What youre entitled to depends on your work status.

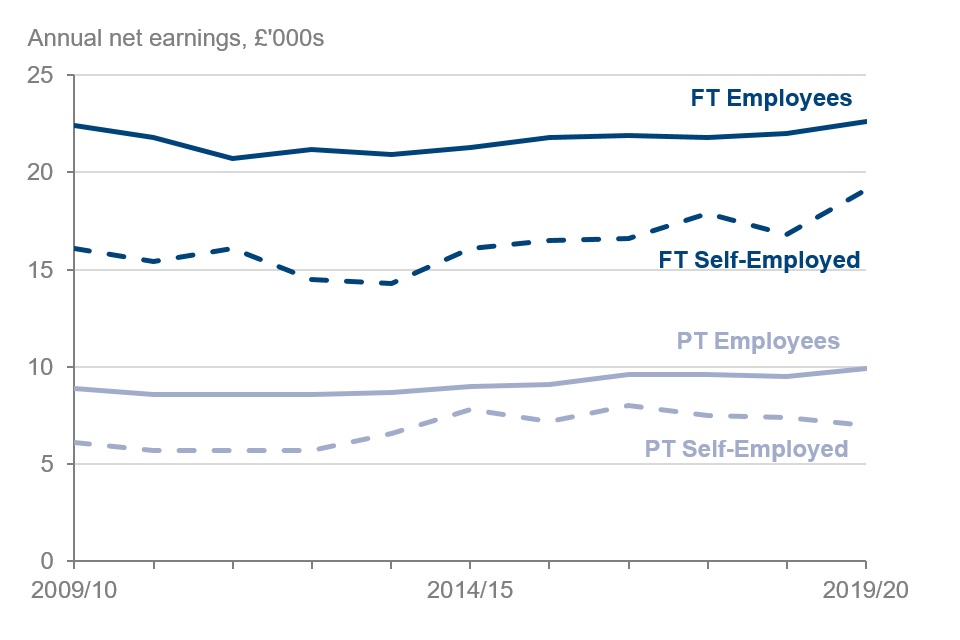

Family Resources Survey Financial Year 2019 To 2020 Gov Uk

Average Salary Uk Are You Earning Below The Average Salary In The Uk

34 000 After Tax Salary Calculator Uk

Basic Paye Tools User Guide Gov Uk

Average Salary Uk Are You Earning Below The Average Salary In The Uk

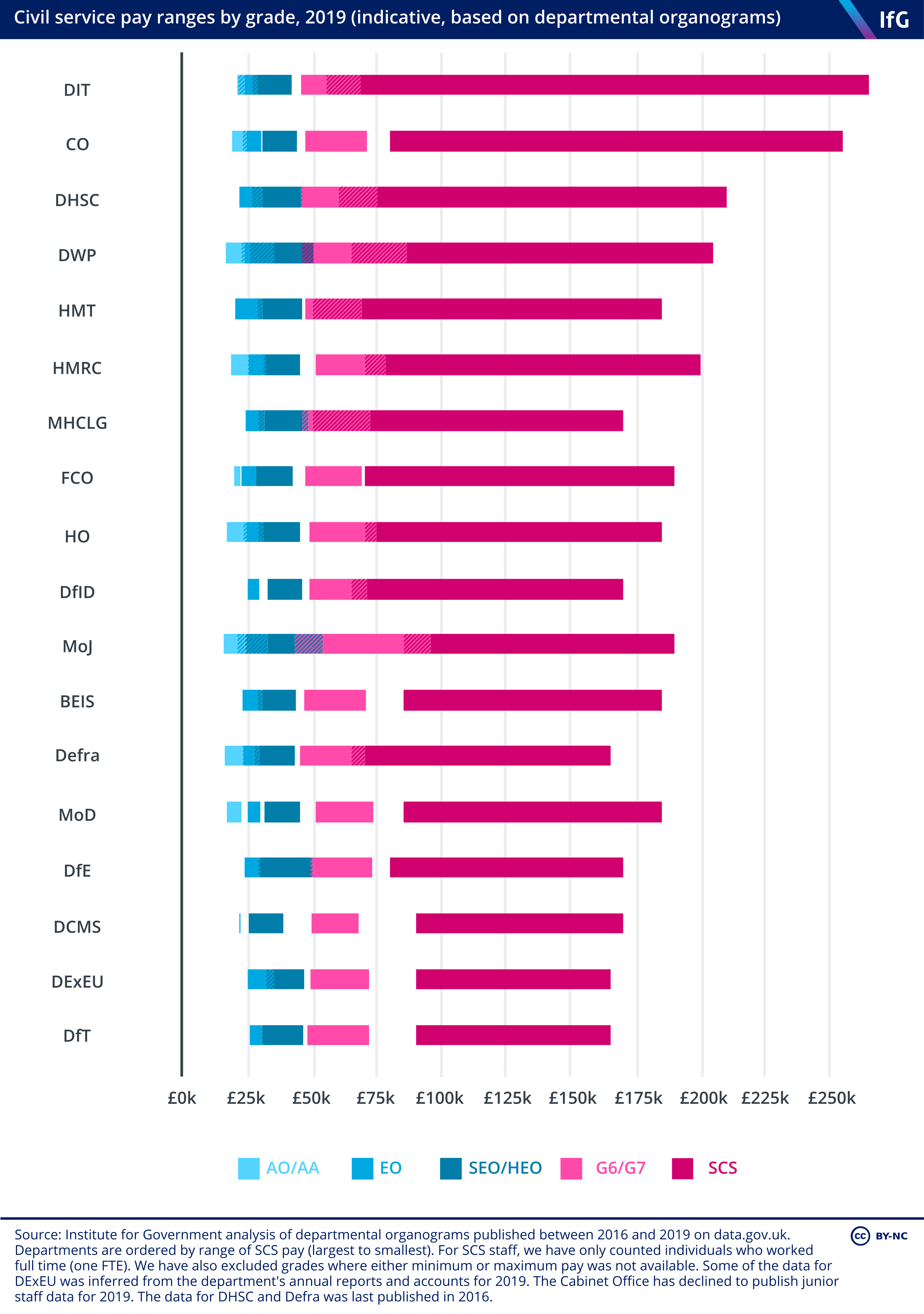

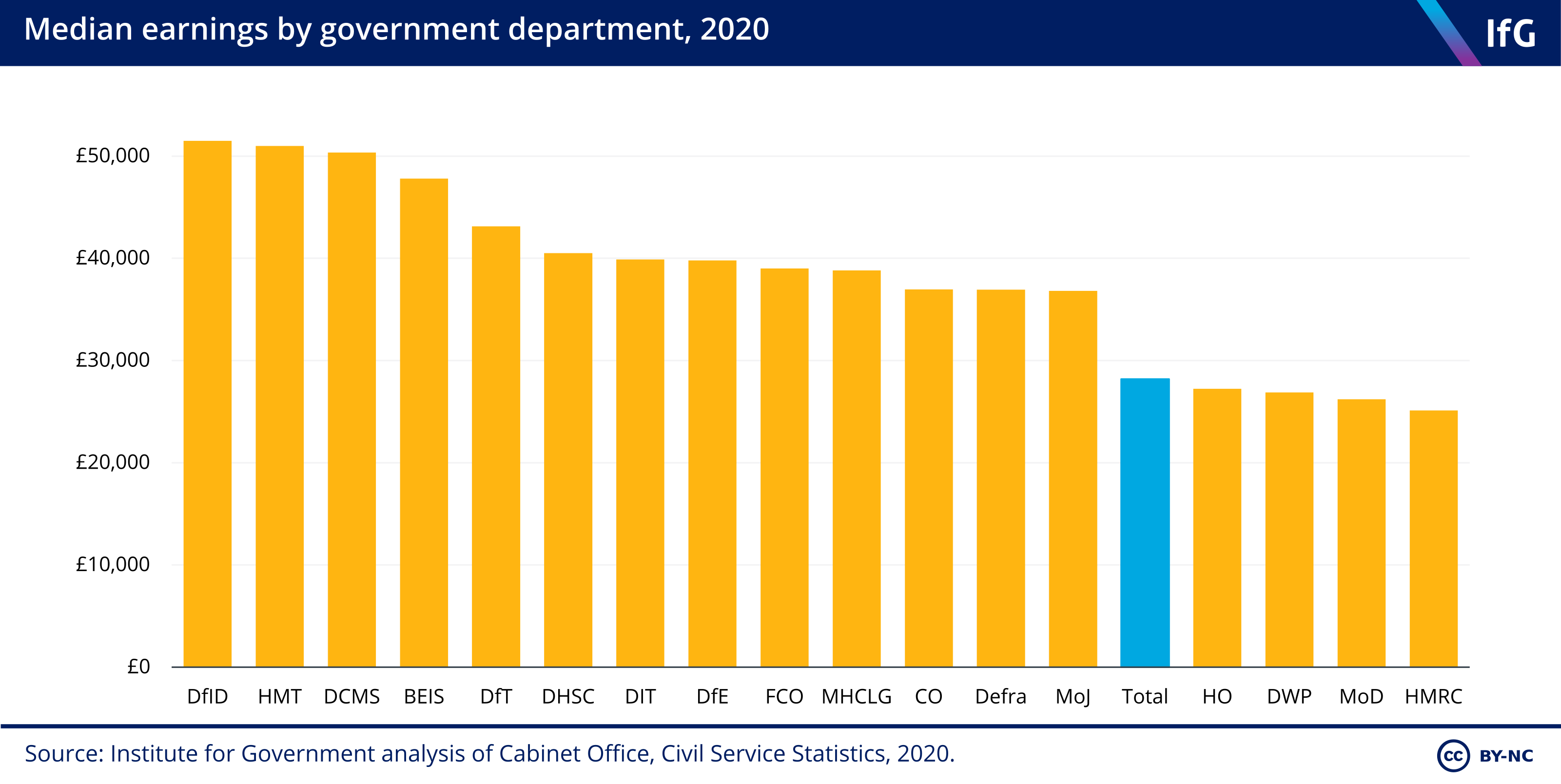

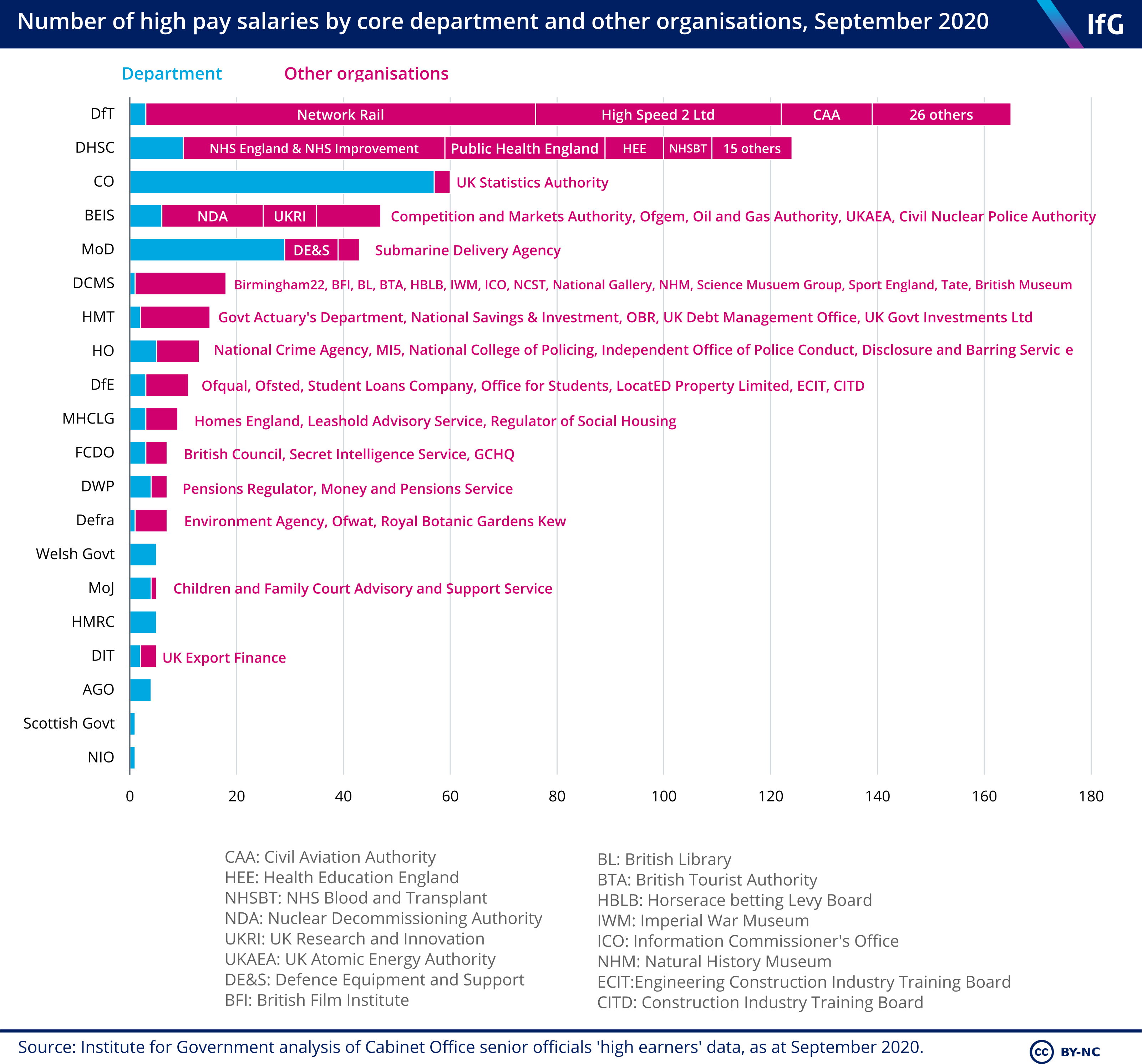

Civil Service Pay The Institute For Government

How To Calculate Your Take Home Salary A Uk Guide

Civil Service Pay The Institute For Government

How Do I Pay Tax Low Incomes Tax Reform Group

80 000 After Tax 2021 Income Tax Uk

Uk Payslip Law 2019 2020 Payslip Legal Info Iris Fmp

Ekosh Online Pay Slip 2021 Ifms Uk Salary Slip At Ekosh Uk Gov In

Civil Service Pay The Institute For Government

Gross Net Salary The Urssaf Converter

Post a Comment for "Net Salary Uk Gov"