Salary Sacrifice Quickbooks

This has been amended in new Quickbooks versions since 200910 to a single payroll item and now ensures that the process has been simplified immensely. Salary Sacrifice is transfered to QuickBooks together with Gross Wages - Reckon Help and Support Centre.

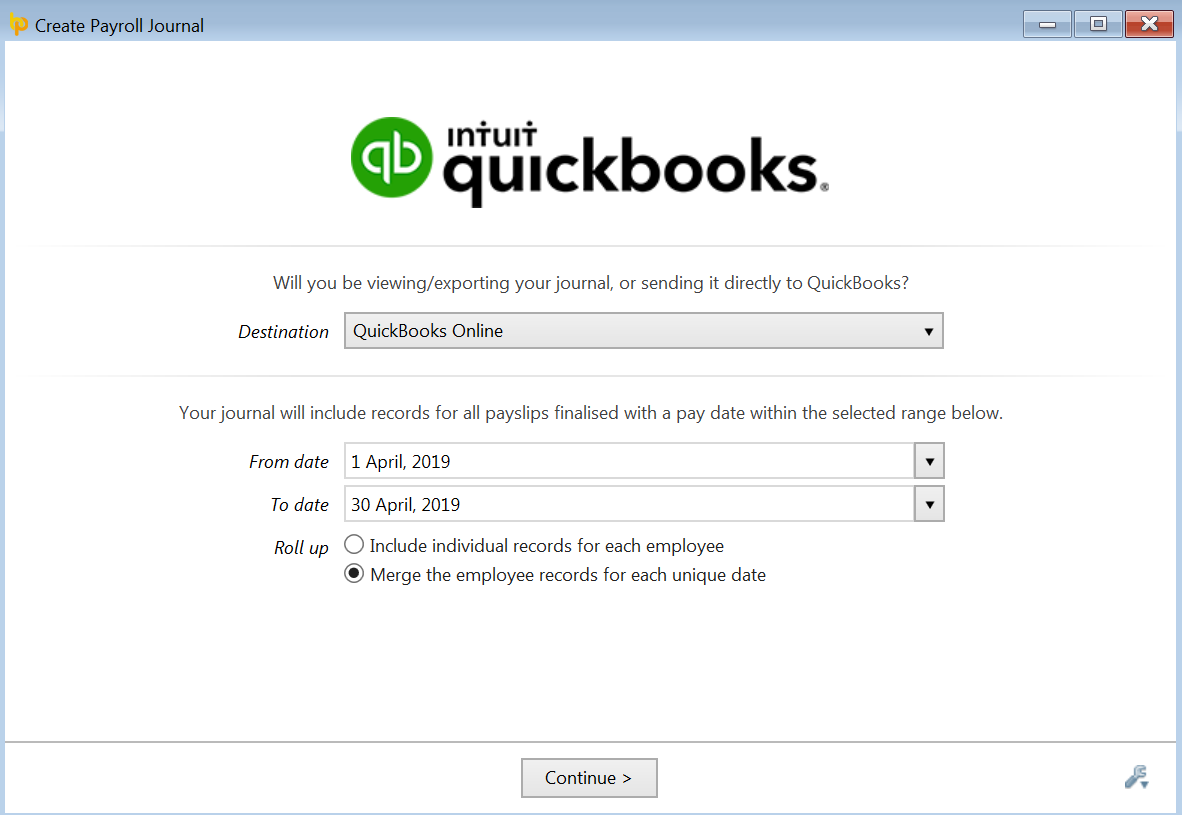

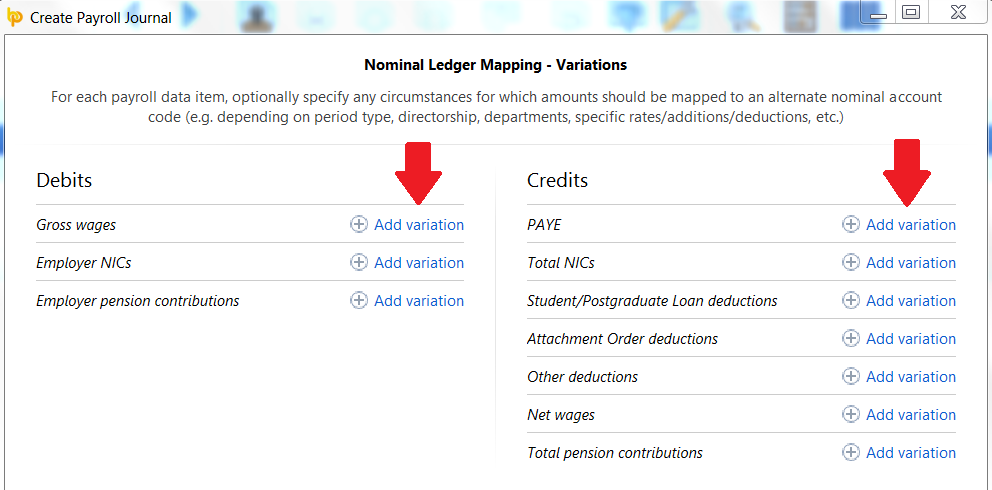

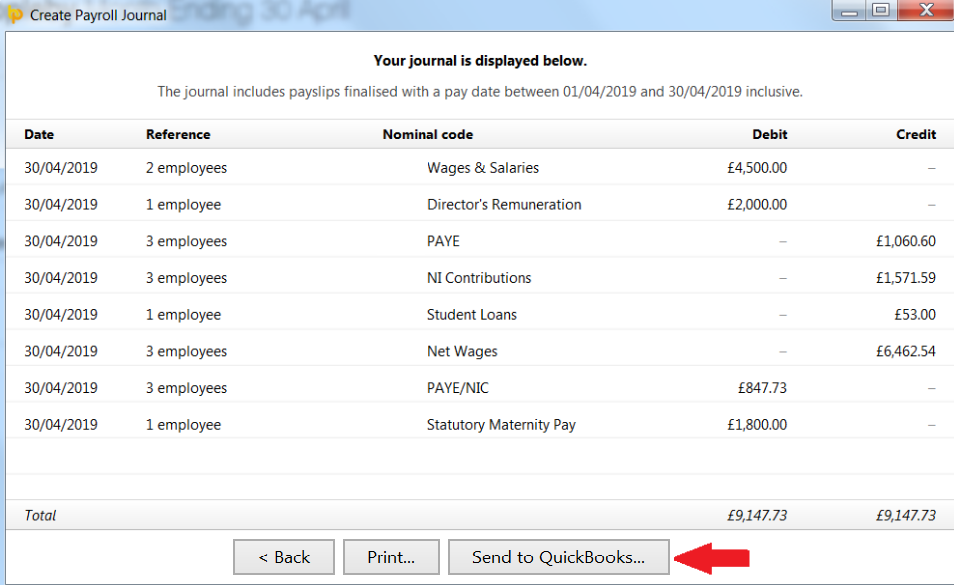

Quickbooks Online Using Api Brightpay Documentation

At the moment we cannot record salary sacrifice on QuickBooks Online Payroll.

Salary sacrifice quickbooks. When processing your next pay run the salary sacrifice deduction will no longer appear for the employees pay. For example a salary sacrifice arrangement for a laptop can be set up as a deducti. SGC super is calculated on the Pre salary sacrifice Taxable wages.

It can be a Fixed amount a Percentage of Gross earnings or Percentage of OTE. 0 Kudos Cheer Reply. Below is an example of the payment coding.

Enter the deduction amount to be applied per pay run. Enter the or amount 100 in this case set the payment method to pay a super fund and select a fund from the drop down menu choose the effective from date. Before Salary Sacrifice is entered.

To set one of those up Put your mouse over the cog in the top right hand corner and then select settings. Select the Salary sacrifice super deduction category from the drop down list. Salary Sacrifice deductions are pre-tax deductions that are sent to a super fund.

Previously in Quickbooks in order to have salary sacrifice calculate correctly two payroll items a Company Contribution Item and a Deduction item needed to be set up. If the amount is on top of the gross that is more likely to be a company contribution. Select the way the amount will be arrived at.

You could do it this way and have it appear then as a salary sacrifice which would then change her gross figure and compensate this with the salary sacrifice figure. HI lauraringgold Thank you for contacting the Community. Im trying to set up the contribution rate - there are boxes for Eee contribution Eer Contribution Salary Sacrifice and NI - Im not sure what Im supposed to so with these they are not included in the instructions.

QB help chat has suggested reducing my salary through a regular deduction but I cant find a pre-tax deduction option were using QB Online. Running it as a post-tax deduction would surely defeat the point of salary sacrifice. They could also be set up in different ways depending on their nature.

You will notice the reduction in Taxable Wages and Tax as well as an additional accrual journal for salary sacrifice. She also salary sacrifices 1000 each month. We can however record this via our other payroll software PaySuite.

However as tax was presumably never reduced you would need to ensure that you reinstated the original amount of tax deducted if it changes. I expected the system to look at an employees notional salary and. For many salary sacrifice payroll items to be setup in QuickBooks.

A salary sacrifice is for when someone has X gross and then deducts an amount from that gross amount. A change was introduced on 1 January 2020. You can find more on this here.

My salary sacrifice is not reporting correctly in the STP report. Click Employee and deselect the employee to whom the salary sacrifice applied. What is the best way to set this up.

How to add a super salary sacrifice item to an employees pay in Reckon Account Hosted. QuickBooks would be used in the followin. Setting up a pension salary sacrifice scheme on Advanced payroll we will be using it for the first time this month.

As a result of assigning a Salary Sacrifice deduction to a Manual payment the system will not view this as a super deduction but instead as a basic. Select Salary Sacrifice to Super as the type of deduction. There is a thorough and detailed explanation of how to handle salary sacrifice in QuickBooks 200910 onwards.

If you wish to switch to this software please visit our contact page and give us a call and we can raise the request for you. How do I fix this. Look at the link.

Wed like to run the pension as salary sacrifice. Salary Sacrifice SS arrangements and Other Employer Additional EA amounts Example Mary who receives 5000 per month has negotiated a 12 super instead of the statutory requirement of 9. It is correct in Quickbooks.

What this would mean then is that she has had too much tax taken out of her pay and. After the salary sacrifice has been entered. Setting up a non-super Salary Sacrifice item for a salary package Using the data file in a previous version of QuickBooks after converting to a newer version We.

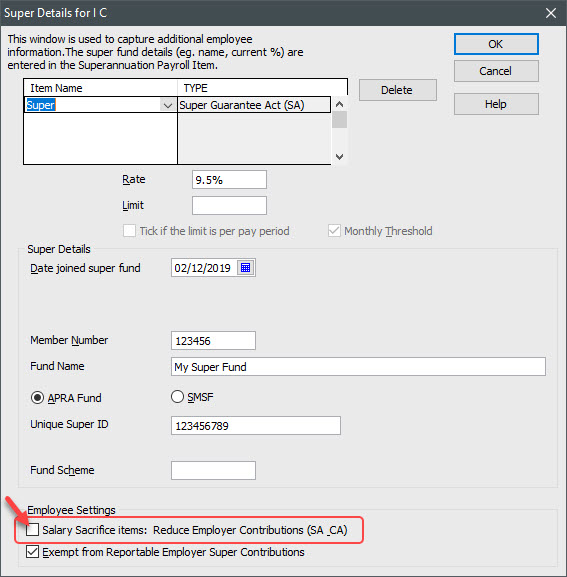

A common mistake made with these deductions is to set them as a manual payment instead of to a super fund. Click the zoom arrow next to the Salary Sacrifice deduction category. Setting up a recurring deduction - salary sacrifice super.

While it is an old article the procedures remain valid today.

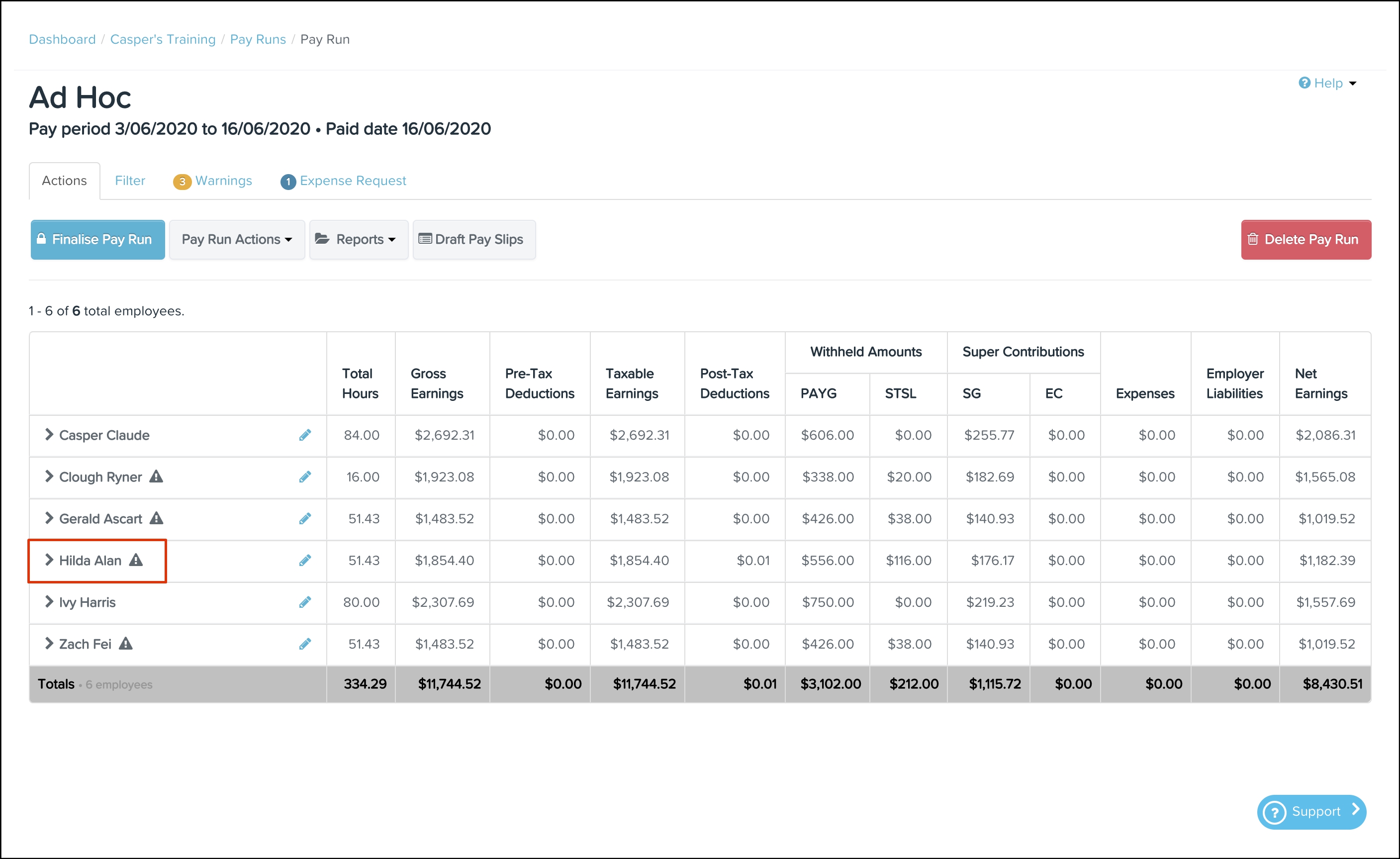

Solved Salaried Employees Do Not Show Salary In Pay Run

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

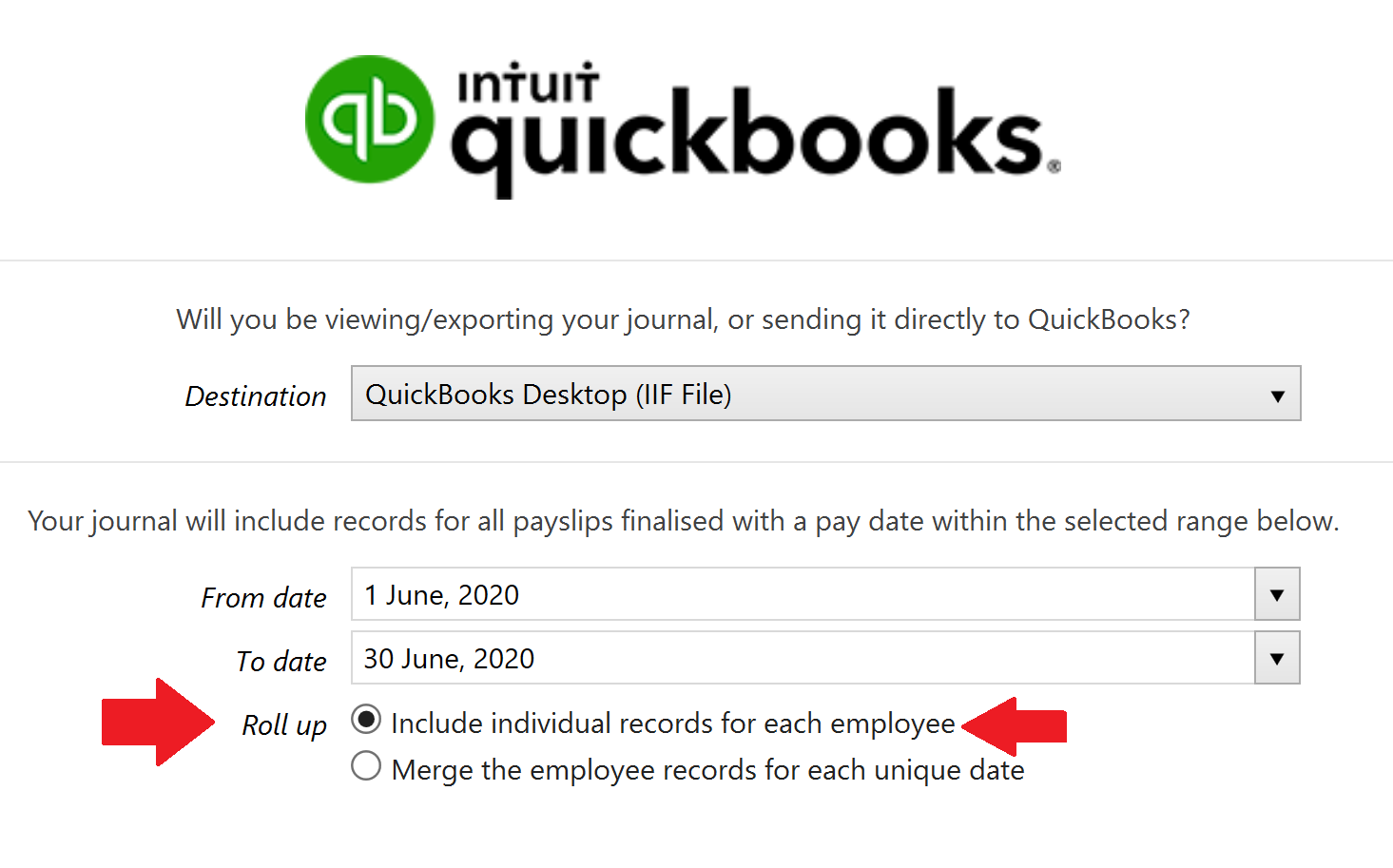

Quickbooks Online Using Api Brightpay Documentation

Solved Salaried Employees Do Not Show Salary In Pay Run

Salary Sacrifice Super Offsets January 1st 2020 What You Need To Know T3 Partners Bas Agents Training And Consulting Online Service

Quickbooks Online Using Api Brightpay Documentation

Reckon Accounts Hosted Create A Super Salary Sacrifice Item Youtube

How To Stop Reducing Sg From Salary Sacrifice New Law Effective From 1 Jan 2020 In Reckon Accounts Reckon Help And Support Centre

Guide Reversing A Manually Processed Salary Sacrificed Super Payment Employment Hero Helpcentre Au

Reckon Accounts Hosted Pay Payroll Liabilities Youtube

Understanding W1 And W2 Tax Codes In Qbo Payroll Support Au

Akuntan Proyek Cara Melihat Reports Total Expenses Di Intuit Quickbooks Online Su Selviautama

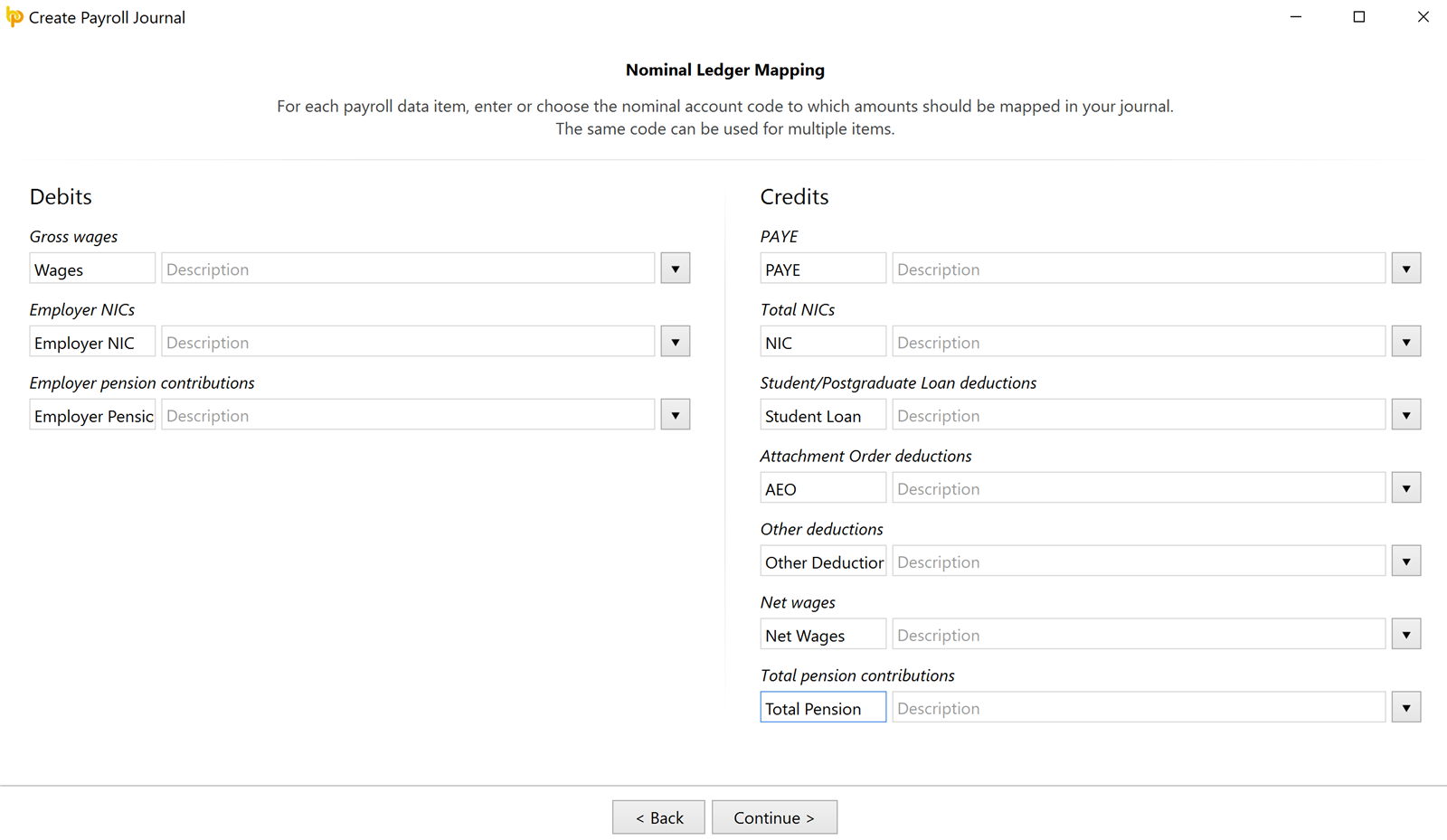

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Quickbooks Desktop Version Csv Upload Brightpay Documentation

Post a Comment for "Salary Sacrifice Quickbooks"